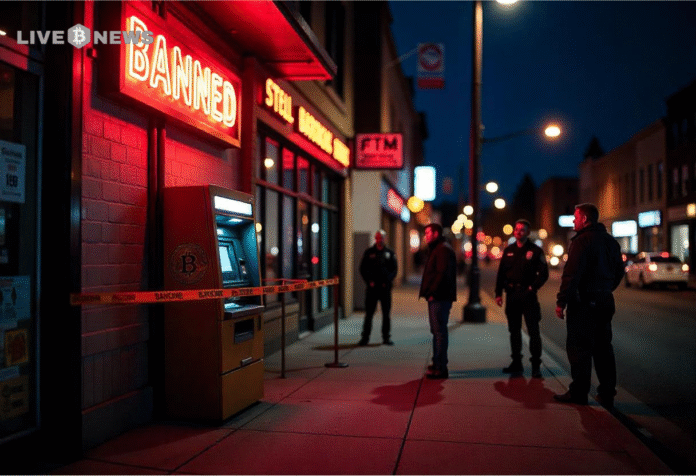

Virginia lawmakers advance a crypto kiosk regulation bill introducing licensing, limits, fraud safeguards, and consumer protections, now awaiting the governor’s final approval.

Virginia lawmakers have approved a new crypto kiosk regulation bill. The legislation now awaits the governor’s signature. The proposal is to mitigate against the increasing losses due to scams. Lawmakers say the move is to protect the consumer before fraud expands.

Bill Introduces Statewide Rules for Crypto Kiosk Operators

The bill was sponsored by Democratic delegate Michelle Maldonado of Manassas. She cited some reported cases of scams across Virginia. One Southwest Virginia victim reportedly lost $15,000. Additional cases were reported from Fairfax County. These examples influenced the urgency and direction of the bill.

Related Reading: Senate Confirms Crypto Bill Talks With SEC Chair!!

According to statements shared during discussions, scams account for about 7% of the crypto kiosk industry activity. Lawmakers cautioned that the figure would increase if safeguards were not in place. Therefore, the bill puts clear guardrails for operators in place. The measure includes licensing standards and mandatory reporting requirements.

Furthermore, the legislation enhances the mechanisms of consumer protection. Operators are required to check identification for every transaction. There will be daily and monthly transaction limits. A 48-hour hold period will cover new users. This delay provides for possible recovery of funds in the event of suspected fraud. Warning notices should also be well displayed.

In addition, the bill limits the description and promotion of kiosks. Operators cannot sell machines as traditional ATMs. Lawmakers say this avoids consumer confusion. Officials believe better labeling helps to reduce the risk of misinterpreting services and risks.

Consumer Safeguards Target Common Scam Patterns

Consumer advocacy groups pointed to increased scam exposure among the elderly. Seniors are frequently targets for scams about fictitious debts or threats of legal action. Romantic manipulation scams are also still widespread. These patterns affected the focus of lawmakers in terms of transaction limits. Verification steps are expected to discourage fraudulent activity.

Delegate Maldonado called the legislation a proactive regulation. She focused on prevention rather than reaction. She went on to say that early intervention prevents greater losses later. “This is the time to get things in place to protect against that,” she explained. In her words, it was stressed to stop the growth of scams from 7% onwards.

Industry observers say the bill has the potential to alter the way kiosks operate statewide. Compliance requirements could increase operating costs. However, the supporters claim that the benefits outweigh the adjustments. Consumer confidence tends to fall following scam headlines.

If the governor signs the bill, enforcement will be performed according to statewide implementation guidelines. Regulators will monitor licensing and reporting of operators. Consumer safeguards will be made mandatory. Better fraud detection and response are expected from authorities. Lawmakers think early regulation means safer cryptocurrency access.

In conclusion, the Virginia crypto kiosk bill has a good motive of protecting consumers from scams effectively. It includes licensing, transaction limits, ID verification, and glaring warnings. Early regulation aims to avoid losses and confusion in order to make cryptocurrency usage safer. If passed, the law could create an important precedent for statewide consumer protection.