Key Insights:

- Three major US economic indicators could affect Bitcoin’s price direction this week.

- A deeper-than-expected decline in retail sales could be bullish for Bitcoin.

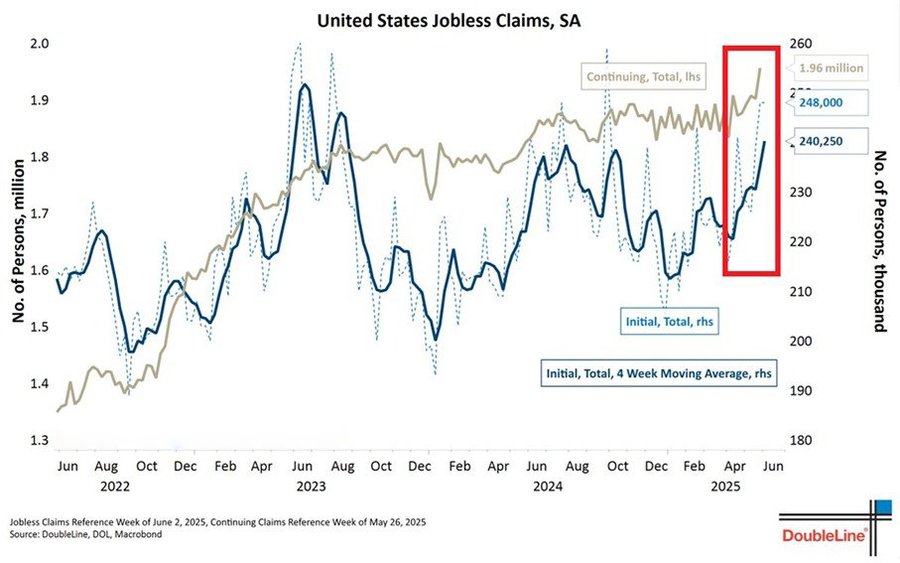

- Rising jobless claims show a weakening labor market, which could prompt the Federal Reserve to loosen monetary policy.

The crypto space is bracing itself for another massive week, as three important US economic indicators are gearing up to steer the market sentiment.

The price direction of Bitcoin during the week could depend on these indicators, especially with recent inflation data already stirring speculation about a Federal Reserve policy shift.

Attention is now turning towards retail sales figures, jobless claims, and the much-anticipated interest rate decision from the Federal Open Market Committee (FOMC).

Here’s how these economic levers could affect the crypto market in the days ahead.

Retail Sales, Consumer Spending Take Center Stage

For those unaware, consumer spending drives nearly 70% of the US economy. This makes retail sales a very important metric for determining economic health.

The US Census Bureau’s monthly retail sales report, in particular, is one of the most significant insights into factors such as consumer confidence, purchasing power, and overall economic momentum.

In April 2025, the data showed a modest 0.1% increase in sales.

Key Events This Week:

1. Markets React to Israel/Iran Escalation – Monday

2. OPEC Monthly Report – Monday

3. May Retail Sales data – Tuesday

4. Fed Interest Rate Decision – Wednesday

5. US Markets Closed, Juneteenth – Thursday

6. Philadelphia Fed Manufacturing Index -…

— The Kobeissi Letter (@KobeissiLetter) June 15, 2025

Fast forward to the readings from May, and economists are forecasting another 0.6% drop.

If this contraction comes to light, it may show that American consumers are starting to pull back amid the economic uncertainty, likely due to the higher borrowing costs, inflation fatigue, and worries over the trade policies that shift every day.

For the crypto market, a deeper-than-expected decline in retail sales could have bullish effects. For starters, a weaker consumer economy raises expectations of monetary easing, and could even trigger interest rate cuts from the Fed.

In turn, this would reinforce Bitcoin’s appeal as a store of value, especially since traditional savings instruments like bonds and gold would offer lower returns.

On the flip side, if the retail sales number surprises to the upside, or even remains flat, the US dollar could strengthen and weigh down Bitcoin/other risk assets.

Initial Jobless Claims

The labor market continues to be a very important piece of the macroeconomic puzzle.

Each week, the US Department of Labor releases data on initial jobless claims, which is the number of Americans applying for unemployment benefits for the first time. This figure provides a real snapshot of job market health.

Last week, jobless claims jumped to 248,000, which is slightly higher than economists’ expectations of 242,000.

US initial jobless claims, Source: X(Twitter)

For the current week, that number is expected to rise again to 250,000.

If the forecast holds or if claims spike even higher, it could be a signal that cracks are forming in the labor market, which has so far been resilient.

A weakening job market increases the likelihood of the Federal Reserve loosening monetary policy to support employment.

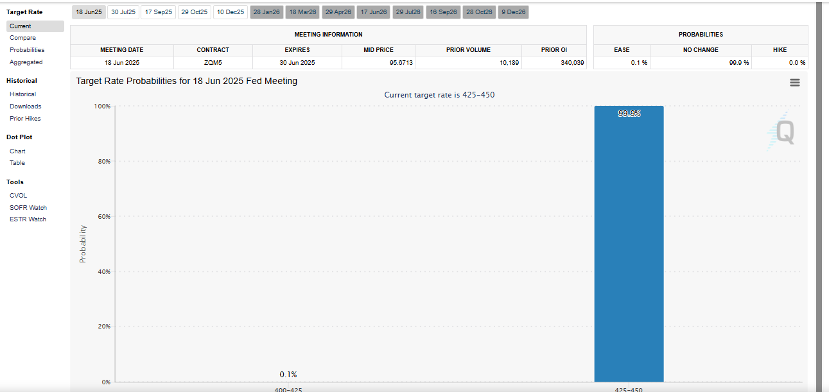

The FOMC Interest Rate Decision

The week’s biggest event will be the FOMC’s decision on interest rates, which is scheduled for Wednesday. This event comes just days after a surprise uptick in May’s Consumer Price Index (CPI), and carries a lot more weight in the crypto space.

Currently, markets expect the Fed to hold its benchmark rate steady at 4.25–4.5%. The CME’s FedWatch Tool even assigns a 96.7% probability to no change.

Still, a small 3.3% chance stands for a 25-basis-point cut, which would lower the rate to 4.0–4.25%.

FED interest rate forecast, Source: CME

If the FED defies expectations and cuts rates, the crypto market could end up hit really hard.

Lower interest rates would reduce the opportunity cost of holding non-yielding assets like Bitcoin, and therefore make them slightly less attractive to the average investor. At least compared to other assets, such as government bonds.