Main heading: Pi and Cardano Are Trending Again, But Web3 ai’s AI Tools and 1,747% ROI Are Making it Crypto with the Highest ROI

Pi Coin and Cardano are showing renewed strength as short-term traders return to technical setups with momentum potential. The Pi chart pattern is forming a symmetrical triangle that analysts say could trigger a 20% breakout. Meanwhile, Cardano is trending again following reports that a pending ADA ETF could push its price toward $0.80, according to recent projections.

But despite the headlines, neither Pi nor Cardano is offering what investors are increasingly seeking in 2025, early-stage entry with real utility and massive ROI potential. Web3 ai, currently priced at just $0.000402 in Stage 07 of its presale, has already raised over $6 million and is offering a projected return of 1,747% at launch. Its flagship AI-Powered Risk Management Tool provides real-time portfolio protection, helping Web3 ai stand out not just as a trending project, but as the highest ROI crypto right now.

Heading: Pi Chart Pattern Signals Possible 20% Breakout

The Pi chart pattern is one of the clearest short-term technical setups in the market today. Analysts are closely watching a symmetrical triangle forming on the Pi daily chart, suggesting that a breakout could be imminent. If bullish momentum continues and price breaks the upper resistance line, a 20% upside move is likely.

This pattern is being supported by stabilizing volume, a series of higher lows, and strong consolidation just below resistance. Some traders are eyeing the $0.85–$0.98 zone as the next target range, especially if Bitcoin maintains broader market strength. However, there are caveats. Pi still lacks strong ecosystem news, partnerships, or development updates that could give the move lasting power.

While the Pi chart pattern presents a compelling case for short-term gains, it doesn’t offer long-term investors much to work with beyond technical volatility. That’s why capital is rotating into presales, where the upside is backed by utility, and not just speculative movement.

Cardano (ADA) Price Analysis: ETF Speculation Drives Bullish Outlook

The latest Cardano (ADA) price analysis focuses on the potential for an ETF approval, which could send ADA toward $0.80. As of now, Cardano is trading near $0.74, and some traders expect a breakout if the ETF becomes reality. The move is also supported by a solid technical foundation, with price holding above major moving averages and a slow-building uptrend from recent lows.

Beyond the ETF narrative, Cardano’s fundamentals remain strong. The network continues to roll out updates, and the ecosystem has grown to support hundreds of projects. On-chain data shows increased activity, and staking remains one of the platform’s core strengths. That said, Cardano’s current price is still heavily reliant on macro sentiment and regulatory news.

Despite the positive Cardano (ADA) price analysis, ADA’s large market cap naturally limits its ROI potential compared to smaller-cap projects. For investors focused on aggressive growth, especially in early stages, other platforms are increasingly being favored as the highest ROI crypto options.

Web3 ai: AI Risk Tool, $0.000402 Price, and 1,747% ROI

Web3 ai is building investor confidence not just through price speculation, but with a functional platform offering real AI tools for crypto risk management. Currently in Stage 07 of its presale and priced at $0.000402, the project has already raised over $6 million. Its projected launch price is $0.005242, offering early participants a 1,747% return on investment.

At the heart of Web3 ai’s offering is its AI-Powered Risk Management Tool, scheduled for release in Q2 2025. This system is designed to help users monitor their portfolios in real time, using multiple AI models including Value at Risk (VaR), Monte Carlo simulations, and token interconnection analysis. It simulates market conditions and quantifies portfolio exposure, alerting users to potential threats before they occur.

In addition to real-time simulations, the tool includes automated stop-loss execution and customizable risk alerts. Users can choose how they receive notifications, via email, messaging apps, or dashboard alerts, giving them flexibility and control. The tool adapts to changing market dynamics and can track correlated assets to prevent cascading losses, a feature increasingly in demand among active crypto investors.

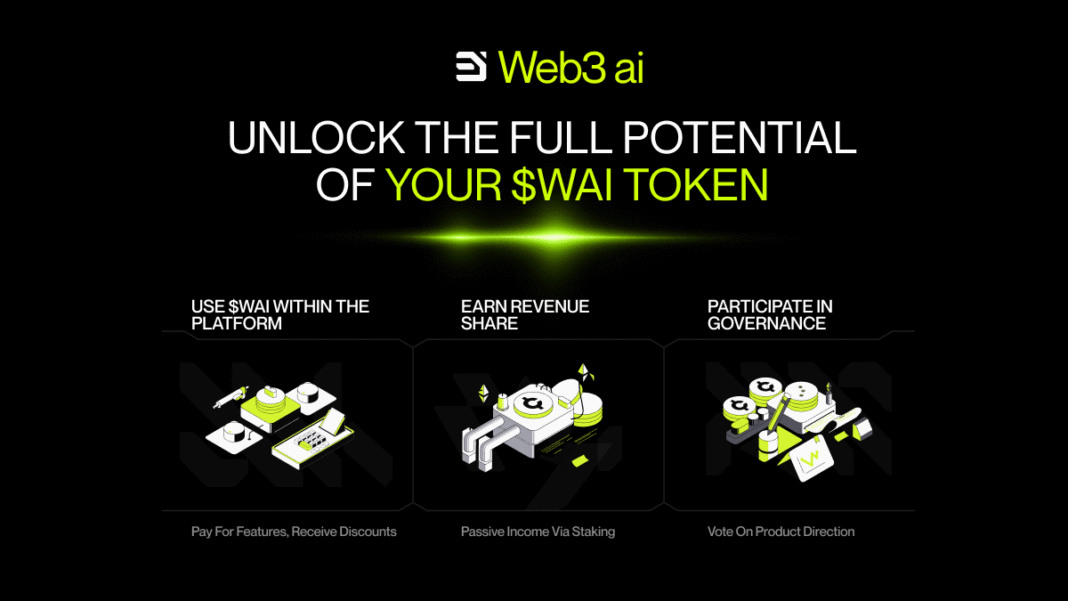

This forward-thinking utility is what’s setting Web3 ai apart. While Pi and Cardano continue to trend based on charts and ETF rumors, Web3 ai is solving a real problem for DeFi and CEX users alike. With the $WAI token powering tool access, governance, and staking, Web3 ai delivers infrastructure, not just hype. And that’s exactly why it’s quickly becoming the highest ROI crypto in 2025.

Momentum vs Utility in the 2025 Race

The Pi chart pattern points to a potential 20% rally, and the Cardano (ADA) price analysis highlights ETF-fueled potential toward $0.80. Both are trending, but their upside is limited either by technical constraints or regulatory speculation. For short-term traders, they may still deliver results, but long-term investors are looking elsewhere.

Web3 ai offers a different proposition. With a $0.000402 price, over $6 million raised, and a projected ROI of 1,747%, it’s backed by a platform that delivers real-time AI-powered risk management. As utility and risk control become central to investor decision-making, Web3 ai isn’t just trending, it’s leading. That’s why it’s now being recognized as the highest ROI crypto of 2025.

Join Web3 ai Now:

Website: http://web3ai.com/

Telegram: https://t.me/Web3Ai_Token

Instagram: https://www.instagram.com/web3ai_token

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.