ETH hits record highs close to $5K, but signals point to caution. Will Ethereum break $6K or correct?

Ethereum reached a new record near $5,000 this week, creating debate over whether the rally will extend or stall. The asset has gained strong institutional backing in recent months, with large corporate treasuries driving demand. Yet, technical indicators and trading activity now suggest that a possible short-term correction could occur before another breakout.

Ethereum Rally Faces Resistance Near $5,000

Ethereum closed above $4,600 on the weekly chart for the first time, confirming a new all-time high. Traders pointed out that the $3,900–$4,800 range had been a tough barrier for months. By clearing it, Ethereum entered a zone where selling pressure often increases.

Despite the bullish move, analysts warned that the $5,000 level may be difficult to cross without stronger momentum. Furthermore, the $5,100 level would be a critical resistance to watch. Many investors are cautious since Ethereum is now trading near its peak, where volatility often rises.

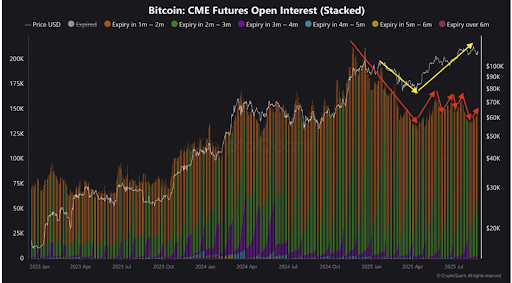

CryptoQuant data shows that futures open interest for Ethereum has increased alongside price, showing fresh inflows from institutions. By contrast, Bitcoin open interest has lagged, suggesting less participation compared to Ethereum. This divergence has positioned Ethereum as the stronger short-term performer among the two largest cryptocurrencies.

Corporate Demand Strengthens Ethereum’s Position

BitMine Immersion Technologies expanded its Ethereum holdings last week, adding more than 190,500 ETH. The company now controls about 1.7 million ETH, which equals nearly 1.5% of the total supply. Its chairman Tom Lee said the goal is to secure around five percent of all Ether.

Tom Lee's Ethereum Treasury Company Bitmine $BMNR now holds more than $8.8 Billion worth of ETH + Cash up from the $6.6B last week

BMNR now owns 1.71 Million ETH and 192 BTC pic.twitter.com/rbayqJENZ1

— Tom Lee Tracker (@TomLeeTracker) August 25, 2025

SharpLink Gaming has also accumulated a large Ethereum treasury, reporting over 728,000 ETH under management. Together, these corporate reserves have lifted total company holdings of Ethereum to about 4.3 million ETH. This accounts for nearly 3.6% of the circulating supply, with ETFs owning another 6.5 million ETH.

The combined weight of treasuries and ETFs has pushed Ethereum demand higher over the summer. July recorded the biggest monthly increase in corporate ETH reserves on record, growing by more than 127%. These purchases have added to the upward pressure on Ethereum even as retail demand remains moderate.

RSI Divergence Signals Possible Pullback Before $6K

Technical analysis shows that Ethereum may face short-term pressure despite the bullish long-term outlook. Analysts note that the Relative Strength Index is diverging from price, with momentum slowing as Ethereum sets higher highs. This pattern sometimes leads to pullbacks before another upward move.

Ethereum’s RSI is showing higher lows even as prices rise, which creates mixed signals. While divergence often suggests weakness, higher lows in RSI indicate that downside momentum is not yet strong. This combination suggests that Ethereum may trade sideways before deciding its next move.

Trading volume has been lower during the most recent push higher, which raises concern about the strength of the rally. Without stronger participation, Ethereum may pause near $5,000 before attempting to reach $6,000. The next few weeks will be key for determining whether the asset breaks higher or faces correction.