XLM rally momentum weakens as open interest drops 50%, raising concerns over bullish continuation near $0.41 support.

Stellar (XLM) is facing a critical moment as traders debate whether the recent rally can sustain itself. Market data shows weakening momentum, with open interest falling sharply and chart patterns creating uncertainty about the next move.

XLM Price Holds Near $0.41 as Analysts Monitor Key Levels

Crypto analyst Naveed stated on X that Stellar’s price has been consolidating above the $0.413 level. He noted that liquidity was swept below $0.40 before price tagged a fair value gap and began showing accumulation signs. Naveed added that maintaining strength above $0.413 could give bulls a springboard toward short-term upside targets.

$XLM looking interesting here 👀

► Price swept liquidity below, tagged FVG and showing signs of accumulation

► Holding above 0.413 is key – could be the springboard for the next move

► Targets remain around 0.426 → 0.438 → 0.455, with liquidity sitting at 0.468 (weak… https://t.co/09Irno9rNP pic.twitter.com/pPFMQGZPGt

— Naveed (@navex_eth) August 24, 2025

According to his analysis, XLM faces resistance at $0.426, $0.438, and $0.455, with liquidity sitting close to $0.468. He mentioned that a break below $0.39 would weaken the bullish case and open risks for further losses. These levels remain crucial for short-term traders as price action continues to narrow.

Stellar’s capitalization nears $12.82 billion, ranking it 19th among cryptocurrencies. During the last 24 hours, XLM traded between $0.408 and $0.418 with volume at $196.5 million. This sideways activity reflects consolidation and the absence of a strong directional push.

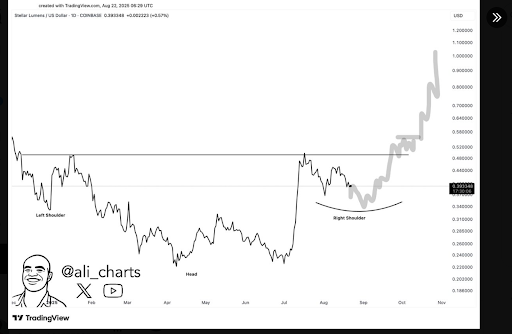

Head-and-Shoulders Pattern Signals Uncertain Outlook for XLM

Ali Charts posted on X that Stellar is forming the right shoulder of a head-and-shoulders pattern. According to him, the left shoulder formed in February, while the head developed during the May–June lows. The current structure suggests the possibility of a bullish reversal if the neckline is broken.

The neckline near $0.52 is seen as the level that could confirm this setup. A breakout above this point would suggest further upside, with projected targets between $0.80 and $1.00. However, without volume expansion and market confirmation, the pattern remains uncertain and traders remain cautious.

XLM is also preparing for its Protocol 23 upgrade, scheduled for a mainnet vote in late August 2025. The upgrade aims to introduce parallel execution for Soroban smart contracts, raising throughput and reducing fees. Market participants are watching whether this development can provide renewed demand for the token.

XLM Open Interest Drop Raises Concerns for Rally Continuation

Steph_iscrypto warned on X that Stellar open interest has fallen by nearly 50%. He described this as a warning sign that rally fuel may be drying up. The decline suggests that leveraged positions have reduced, limiting the strength of any upcoming move.

Analysts note that falling open interest often signals waning speculative demand and weakening market conviction. Combined with resistance levels and chart patterns, this has raised questions about the sustainability of the recent bounce. XLM rally momentum is now under pressure as the market evaluates the balance between accumulation and fading leverage.

Meanwhile, XLM continues to trade close to its $0.41 support, with volumes showing mixed signals. Whale liquidations earlier in August triggered a 6% decline, adding to short-term volatility. If the support holds, bulls may attempt another push higher, but weakness in open interest remains a critical factor.