Key Insights:

- XLM must close above $1 to validate a long-term bullish breakout, according to Peter Brandt.

- Stellar is gaining momentum from July’s Protocol 23 upgrade and PayPal’s PYUSD integration.

- Institutional tokenization on Stellar now stands at more than $445 million, in a show of strong fundamentals.

Veteran trader Peter Brandt has set his sights on Stellar Lumen (XLM). The analyst now calls it one of the most promising crypto in the charts, and some bullishness could be inbound. However, there’s a catch. For XLM to register any kind of encouraging bullish move, it needs to decisively close above $1 first.

XLM’s Bullish Setup

Peter Brandt, who is known for decades of accurate market predictions, recently highlighted XLM as having “the most bullish chart of all.”

His optimism is centered around two long-term technical formations, including a multi-year ascending triangle and a cup-and-handle pattern. Historically speaking, both of these tend to come before large price movements.

However, for that bullishness to become reality, XLM must meet some very specific conditions. Brandt insists that the altcoin must stay above its April low of $0.20 and more importantly, close above $1 on the monthly chart.

Potentially the most bullish chart of all belongs to $XLM

XLM MUST MUST remain above Apr low and MUST MUST close decisively above $1. Until then this chart will remain range bound pic.twitter.com/NZvKLp5SVW— Peter Brandt (@PeterLBrandt) July 17, 2025

Until this happens, he warns that the price is likely to remain stuck in a range.

His analysis isn’t just technical. It shows a more general market sentiment that sees Stellar as in a great position to ride the next wave of crypto adoption. If it can overcome resistance and confirm the breakout, that is.

“XLM MUST MUST remain above Apr low and MUST MUST close decisively above $1. Until then, this chart will remain range-bound,” Brandt posted on social media.

XLM’s Historical Price Struggles

Stellar’s price history offers context for this outlook. Since hitting its all-time high in early 2018, XLM has been stuck in a symmetrical triangle formation. Despite attempts to break out in 2021 and late 2024, the price has repeatedly retreated.

As of July 19, XLM is trading around $0.50, which is its highest level in over a year. This also stands as a 120% gain since the start of July. Yet it’s still far from the $1 level that Brandt describes as the gatekeeper to further gains.

This barrier isn’t just psychological; it’s structural. A break above it would validate the multi-year bullish formations and could even trigger a rally to Brandt’s long-term target of $7.20.

For some more perspective, this would bring in a 14x return from current levels.

Why July Changed the Game for XLM

July has been a turning point for Stellar, with the cryptocurrency enjoying attention from three major developments. The first of these is Stellar’s upcoming Protocol 23, which introduces improvements that improve smart contract performance and lower costs across the network.

The second of these is how PayPal’s USD-backed stablecoin, PYUSD, is set to integrate with Stellar. This move could massively expand XLM’s utility by enabling near-instant, low-cost cross-border transfers around the world.

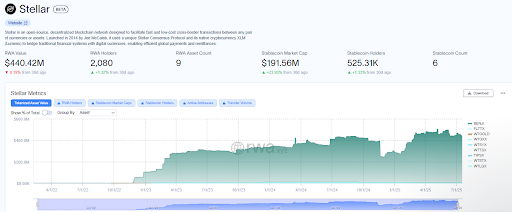

Finally, data from RWA.xyz shows that over $445 million in real-world assets (RWAs) have been tokenized on Stellar.

Large asset managers like Franklin Templeton and Circle are leading this trend, and the future appears bright for this cryptocurrency.

Considering the similarity between XRP and XLM in terms of cross-border payments, XLM could be on the verge of following XRP’s footsteps after the latter recently hit a high of $3.65.