XRP reserves fall as whale inflows slow, signaling supply absorption despite weak momentum.

XRP has tanked from its early-year highs after sellers ramped up activities. And as a result, the coin’s price action and momentum remain weak. Even so, recent on-chain data shows a potential flip in investor behavior.

Exchange Balances Shrink Despite Weak Momentum

Exchange reserve trends often offer early signals of investor intent. According to market analyst Darkfost, data shows a clear contraction in XRP supply held on Binance. Usually, rising reserves signal intent to sell. But declining reserves indicate that holders are transferring assets into private custody.

🗞️ XRP Exchange supply ratio decline signals renewed investor accumulation

"Over the past ten days, the XRP supply ratio on Binance has recorded a notable decline, dropping from 0.027 to 0.025. During this period, approximately 200 million XRP have left the platform.

It is worth… pic.twitter.com/4dFSxeLtcz— Darkfost (@Darkfost_Coc) February 19, 2026

Recent figures show Binance’s XRP exchange supply ratio dropped from about 0.0274 to 0.0255 within ten days. During that same period, reserves fell from roughly 2.74 billion XRP to 2.55 billion XRP. Nearly 200 million XRP left the exchange in a short span.

On February 9, the coin saw a sharp structural decline in balances. After the sharp drop, exchange reserves leveled off and stayed low, with no strong bounce back. That pattern pointed to withdrawals instead of internal exchange transfers. When balances remain low, it often shows that holders prefer to keep their XRP off trading platforms.

Notably, this supply drop happened while the price was falling. XRP declined from above $1.90 to the $1.15–$1.20 area before settling near $1.40. Generally, accumulation during a correction often points to a long-term play by traders.

Source: TradingView

Meanwhile, the RSI on lower timeframes has bounced from oversold levels. However, it remains below the 50 mark, which indicates that buyers are yet to gain upper hand. As per Darkfost, this points to accumulation happening while momentum remains weak.

XRP Down 40%, But On-Chain Data Suggests Accumulation Phase

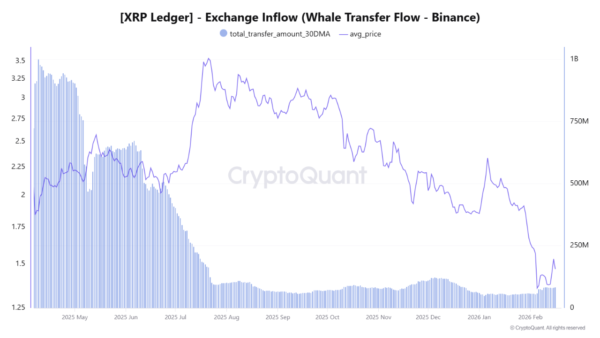

Whale activity offers more insight into current market behavior. Large XRP transfers to Binance have not increased during the recent correction. Instead, the 30-day average of whale inflows has dropped to multi-month lows.

Source: CryptoQuant

Heavy selling usually shows up as clear spikes in exchange deposits. Steady low inflows suggest large holders are not moving quickly to sell.

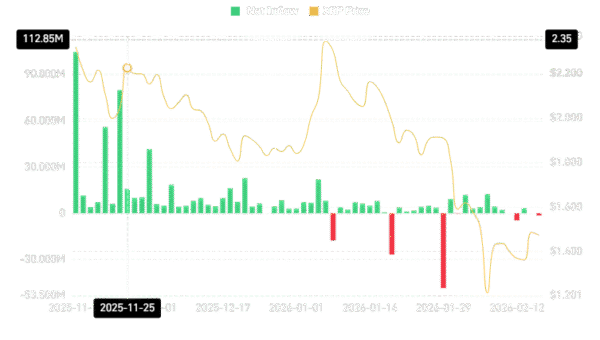

Institutional flows add more perspective to recent price action. Spot XRP ETF products recorded strong inflows when the price traded above $2.00 earlier in the year. As markets corrected, redemptions increased. Recent data now shows those outflows have slowed, with small inflows returning as price begins to stabilize.

Source: CoinGlass

Slower redemptions do not yet point to strong institutional buying. Still, reduced selling pressure from investment vehicles helps reduce downside risk. Even at that, the current setup resembles post-capitulation absorption rather than active distribution.

XRP is down about 40% since the start of the year. Oftentimes, drops of this magnitude often attract long-term buyers who jump on lower prices. The current range-bound trading suggests a balance between careful sellers and steady accumulators.

Darkfost maintains that falling exchange supply alone does not guarantee a quick rally. He added that the price still needs stronger demand and better momentum to confirm a real reversal. Even so, past cycles show that steady reserve declines during weak price periods often come before renewed buying interest.