XRP is trading above the Ichimoku base, and this indicates recovered market confidence and rising institutional ETF inflows that are fuelling bullish momentum.

XRP has shot back above its important weekly Ichimoku line, a technical recovery that indicates new long-term buying power and increasing institutionalism.

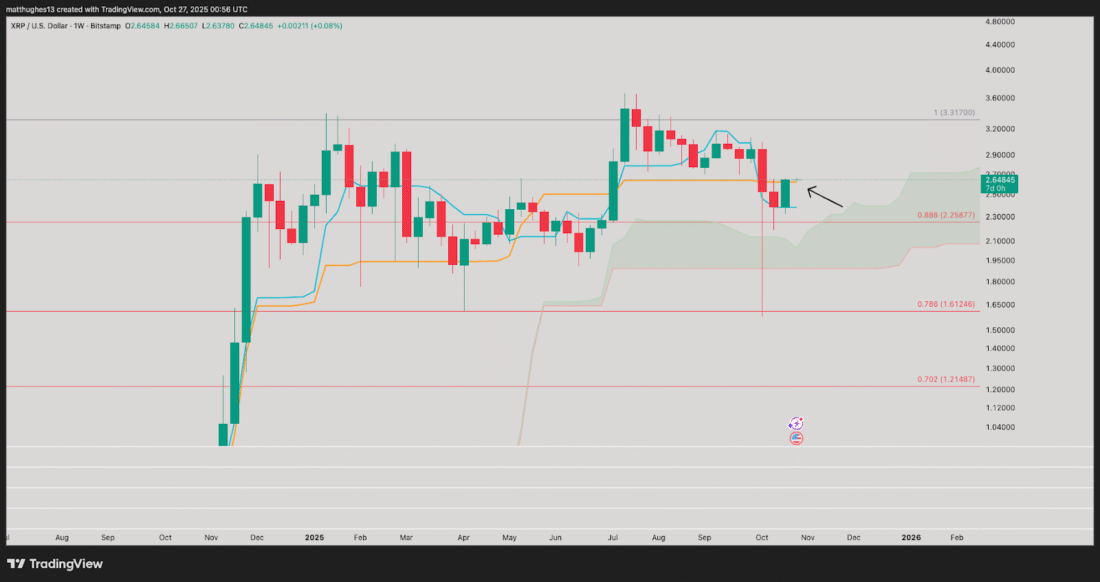

This action is based on the fact that the week past was a strong close of the candles, indicating that more and more control of the market is being taken by the buyers and that more new all-time highs may be made in the future, according to a chart posted on X by analyst The Great Mattsby.

Source -X The Great Mattsby

The market dynamics indicate that XRP is trading at an average of 2.65, and the price range is stable between 2.61 and 2.67.

Recapturing of this baseline will spell the difference between the neutral and possible bullish movement in the medium term.

Along with this breakthrough is the increase in the volume of trading, which is up 19.17% to $4.4 billion as a sign of increased liquidity and market participation.

The factors signify that institutional investors are back, protecting the major demand zones of between 0.45 and 0.50, to instill confidence.

Institutional Interest and ETF Inflows Amplify Optimism

These fundamentals are a complement to the technical strength of XRP. Recently, the first U.S. spot XRP ETF, REX-Osprey XRPR, passed the mark of over $100m assets under management in its first month of operation, a feat illustrating an increase in institutional trust and interest in regulated XRP exposure.

This institutional energy will be instrumental in the context of the present macro arrangement, which will have XRP fighting off the resistance points at around 0.65-0.70.

A firm near these levels can trigger additional bullish trends to the level of $0.80 and above.

The market capitalization of the asset is currently at the point of approximately 157billion, supported by increasing demand and liquidity ratios that support the structural viability.

The technical recovery of XRP, coupled with the explosive inflows of the ETFs and the positive mood of the community of almost 88 per cent of the respondents who report positive attitudes to the product, suggests a new phase of market growth in the future.