XRP rises 3.28% as Nasdaq-qualified XRP spot ETFs open at the U.S. market open, driving great institutional buying and volume blastoff.

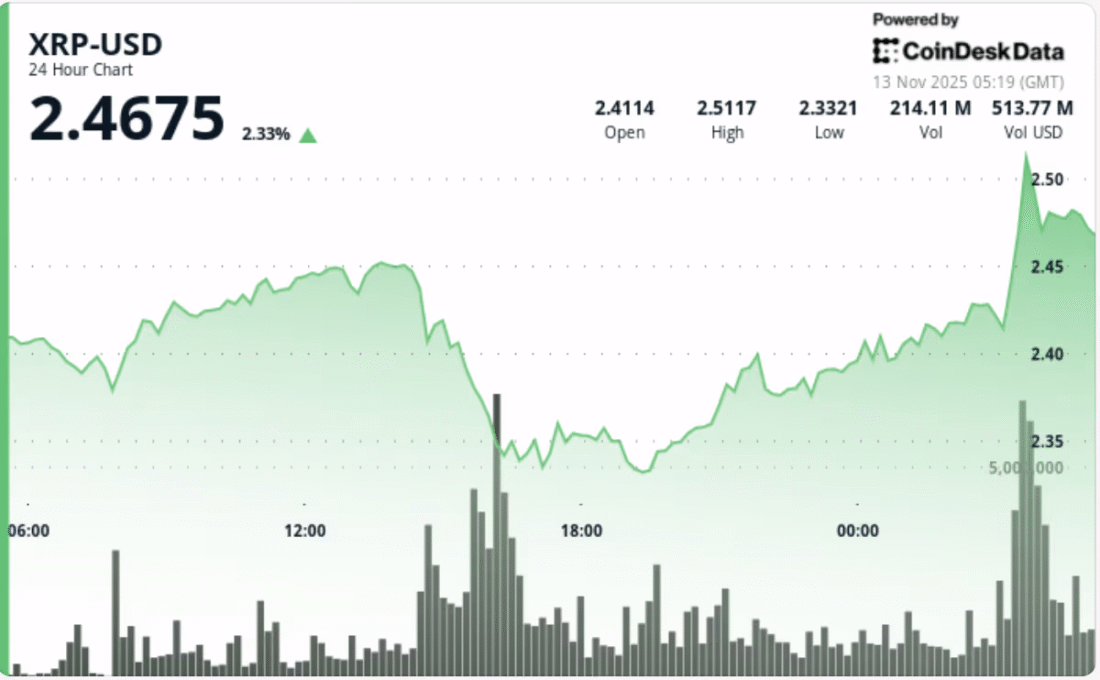

On November 13, 2025, just before the market opened, XRP shot up by 3.28 percent to $2.48 as Nasdaq approved the first-ever U.S. spot XRP exchange-traded fund (ETF), symbol XRPC.

Trade volume surged 31 percent to indicate more positioning by investors expecting the launch of the ETF.

The new ETF is a significant milestone in the availability of crypto assets to U.S. investors. Canary Capital manages it, deposits its XRP in Gemini and BitGo trusts, and prices it using the CoinDesk XRP CCIXber benchmark.

The quick certification by the SEC under the automatic-effectiveness rule is an encouraging sign of an effective regulatory advancement of investment products based on XRP.

Surge in XRP Wallets and Supply Dynamics

The ETF launch triggered a massive interest in on-chain activity, where more than 21,000 new XRP wallets were created in the first two days- the biggest network growth in eight months.

Nonetheless, a few large holders sold about 90 million tokens prior to the opening, which created a short-term supply friction, although the overall sentiment remained bullish.

Price action confirmed institutional participation in the XRP market as it broke through resistance at $2.45 and reached a new high of $2.52 in one session, with trading volume exceeding 2.5 times the daily average.

Technical signals show a strong upward trend and suggest that the price could rise to $2.59 and the key psychological level of $2.70 if the current volume continues.

ETF Impact and Market Outlook

Analysts also expect the ETF to induce major institutional flows comparable to past spot crypto ETP adoption cycles of Bitcoin and Ethereum.

XRP is currently occupying a large space among regulated crypto investment vehicles in the U.S. market, with a possible eruption of a rerating phase as inflows become real.

Early projections indicate that inflows would surpass 5 billion dollars within weeks after launch. The level of support is solid around 2.40, and the level of resistance is at 2.52, with a breakdown below 2.38 creating a downside risk.

The most significant and immediate trigger affecting the price movement and volatility of XRP in the market now is the ETF launch.