Shrinking reserves, negative funding, and steady ETF inflows support XRP bottom formation.

XRP has staged a sharp rebound after printing a 15-month low earlier in February. Price surged 50% to a high of $1.67 from the Feb. 6 low of $1.12, signaling renewed buyer interest after weeks of heavy pressure. Although XRP still trades more than 60% below its multi-year peak of $3.66, several on-chain and derivatives indicators suggest that the recent dip may mark a local bottom.

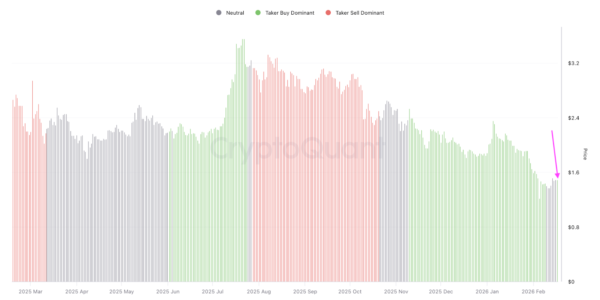

Negative Funding at Multi-Month Lows Sets Stage for XRP Reversal

Exchange data shows a steady decline in XRP balances over the past two years. According to Glassnode, exchange-held supply fell to 12.9 billion XRP this week, levels last seen in May 2021. Lower balances on trading platforms often indicate reduced intent to sell, as holders move tokens into cold storage or long-term custody.

Image Source: Glassnode

Binance’s XRP reserve has dropped to around 2.57 billion XRP, with both the 50-day and 100-day simple moving averages trending downward. Despite price trading near recent lows, reserves continue to shrink. CryptoQuant contributor PelinayPA noted that such a structure increases the probability of a short squeeze, especially if selling pressure fades and buyers regain control.

Funding rates provide further insight into recent positioning. Binance funding fell to -0.028% when XRP touched $1.12, marking its lowest level since April 2025. Negative funding, combined with falling prices, often signals crowded short positions and capitulation among leveraged longs.

History shows that extreme negative funding can precede strong reversals. Similar conditions in April 2025 were followed by a 65% rally from $1.60 to $2.65 as short sellers were forced to cover their positions. Comparable setups in late 2024 also triggered rapid upside moves.

Open Interest Collapse and Rising Spot Volume Point to Recovery Setup

At the same time, futures open interest has contracted sharply. Data from CoinGlass shows XRP open interest declining to $2.53 billion, down 55% from $4.55 billion in early January. Falling open interest during a correction typically signals deleveraging rather than aggressive new short positioning. Reduced leverage can create a cleaner recovery setup if fresh spot demand enters the market.

Several technical and derivatives signals now align around the recent $1.12 low:

- Deeply negative funding rates reflect overcrowded short positioning.

- Open interest contraction suggests forced liquidations and position resets.

- Exchange reserves continue to decline even as price stabilizes near lows.

- Historical patterns show similar conditions preceded sharp rebounds.

Spot market data also points to renewed buyer activity. Analysis of the 90-day spot taker cumulative volume delta (CVD) reveals that aggressive buyers have regained control. Until recently, CVD remained neutral, reflecting hesitation among participants. On Tuesday, the metric turned positive, indicating stronger buy-to-sell volume.

Image Source: CryptoQuant

Sustained positive CVD readings would imply that buyers are accumulating at lower levels. Past recoveries have often begun with a similar shift in spot dominance, followed by a price acceleration.

Capital Rotates Into XRP Products Amid Broader Crypto Fund Outflows

Spot XRP exchange-traded funds have continued attracting capital despite the broader market downturn. Since their launch in November 2025, these products have recorded inflows on 53 of 59 trading days.

Image Source: SoSoValue

SoSoValue data shows that spot XRP ETFs added $4.5 million on Friday, pushing cumulative inflows to $1.23 billion and total net assets under management above $1.01 billion. Even as global crypto investment products posted four consecutive weeks of outflows totaling $173 million, XRP ETPs led weekly inflows with $33.4 million for the week ending Feb. 13.

Persistent ETF demand during price weakness suggests steady institutional interest. If spot buying continues while leverage remains subdued, XRP could build a base above recent lows. Sustained follow-through will depend on broader market conditions, but current metrics indicate that $1.12 may represent a significant turning point in the short term.