Last week, the price of many altcoins surged making up for the losses of the previous few weeks. Ripple XRP price skyrocketed to score a high of 7,400 satoshis on Poloniex yesterday, recording more than 100% gain in market capital in a single week. Litecoin LTC price surged to more than 0.012 BTC, recording around 20% gains within less than a week. Lisk LSK was the biggest gainer throughout last week’s trading sessions as it rose from around 42,000 satoshis to 87,000 satoshis, at the time of writing of this analysis, which yielded an amazing 107% increase in Lisk’s market capital. Some coins started falling since the beginning of the week as Monero XMR, Stellar STR, NEM XEM and Next NXT.

So, what are the best coins one can buy for profit this week?

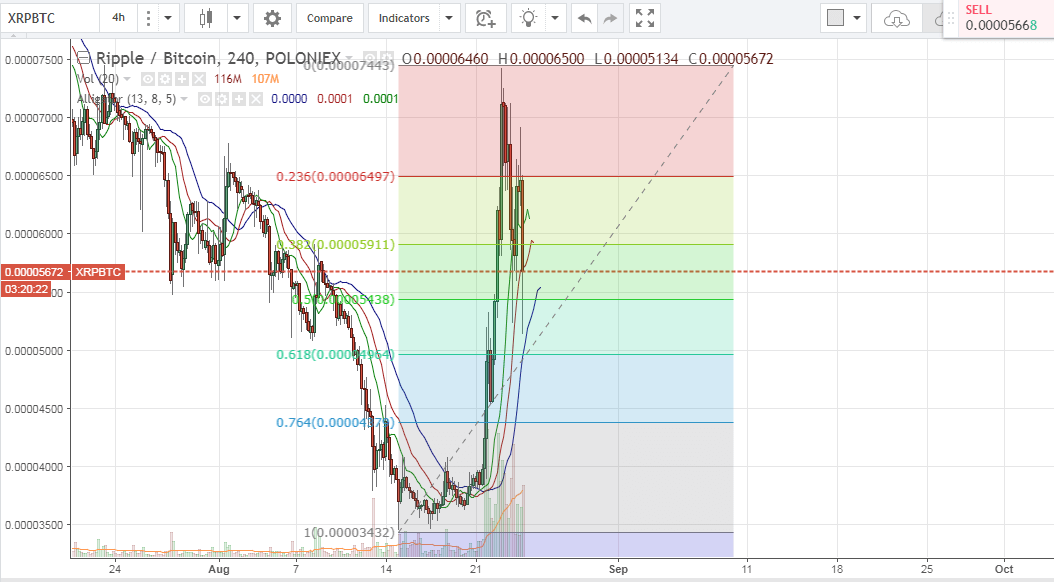

Ripple XRP:

Ripple XRP rose to 7,443 satoshis yesterday, before dropping down to 5,600 satoshis at the time of writing of this article. As shown on the below 4 hour XRPBTC chart from Poloniex, we can now plot a Fobonacci retracement that extends between the low recorded on the 15th of August (3,432 satoshis) and the high recorded on the 23rd of August (7,443 satoshis), to point out key resistance and support levels. The long downwards shadows of the candlesticks near the 50% Fib retracement (5,438 satoshis) denotes the strong support around this level, so the downtrend is likely to be reversed upon testing this support level. This is also supported by the bullish signal provided by the Williams Alligator indicator on the below chart.

I recommend buying XRP between 5,400 an 5,600 and then setting a sell order for the bought coins at 6,497 satoshis which corresponds to the 23.6% Fib retracement.

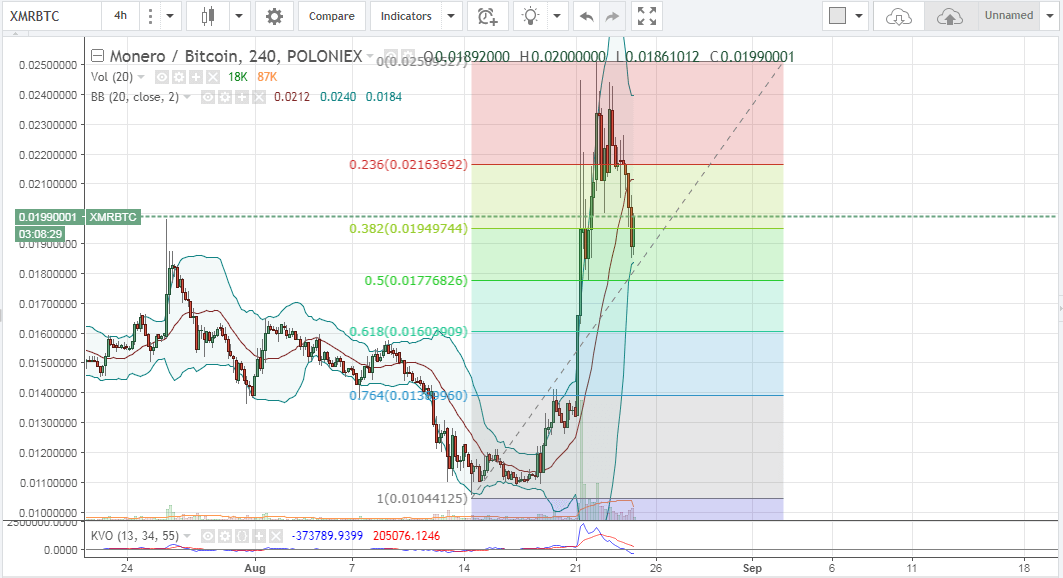

Monero XMR:

Monero XMR started the week by dropping down from 0.025 BTC to 0.0192 BTC at the time of writing of this update. We can plot a Fibonacci retracement extending between the low recorded on the 14th of August (0.01044125 BTC) and the high recorded on the 22nd of August (0.02509527 BTC) on the 4 hour XMRBTC chart from Poloniex, to define key support and resistance levels. The 38.2% Fib retracement level, which corresponds to 0.01949744 BTC, represents an important support level, and the downtrend is likely to be reversed, briefly after testing this level, especially that candlesticks are now touching the lower bollinger band, so we will mostly see XMR price rise towards the middle bollinger band, where the market would be more stable.

I recommend buying XMR between 0.0195 BTC and 0.02 BTC and setting a sell order for the bought coins at 0.02163 BTC or even at 0.025 BTC

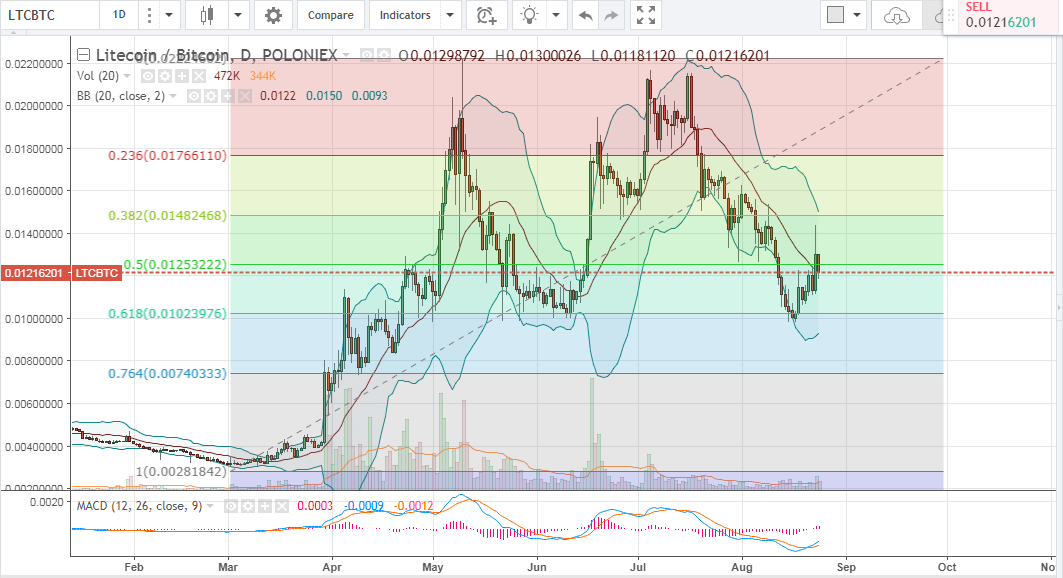

Litecoin LTC:

Last week, LTC started rising following a downtrend that has been driving the market since late July. LTC price rose to record a high of 0.01437 BTC before dropping down to 0.01219 BTC, as this update is being written. As shown on the below LTCBTC 1 day chart from Poloniex, the 50% Fib retracement is currently being tested and is most likely to be breached, especially that the MACD indicator’s positive trend line is above the negative trend line. Also, candlesticks are now near the middle bollinger band soLTC is not overbought and we are likely to see it continue rising towards the next resistance near the 0.01482458 BTC price level which corresponds to the 38.2% Fib retracement.

I recommend buying LTC between 0.0121 BTC and 0.0122 BTC and setting a sell order for the bought coins at 0.0148 BTC.

Charts from Poloniex, hosted on Tradingview.com