Bakkt is jumping fully into the Bitcoin market with a surprising acquisition. The US-based digital asset platform has purchased a 30% stake in MarushoHotta, a 120-year-old Japanese textile manufacturer.

The $115 million deal marks Bakkt’s biggest change yet, as it plans to rebrand the company as “Bitcoin.jp” and transform it into a crypto treasury operation.

Bitcoin.jp As A New Beginning for Bakkt

Marusho Hotta, was traditionally a yarn and textile maker. However, it will soon become Bitcoin.jp, and become more focused on Bitcoin as a treasury asset.

Crypto infrastructure firm Bakkt announced plans to acquire approximately 30% of Japanese publicly listed company Marusho Hotta, with plans to rename it “bitcoin jp” to advance its corporate bitcoin treasury strategy. Upon completion of the deal, Phillip Lord, President of Bakkt…

— Wu Blockchain (@WuBlockchain) August 6, 2025

Bakkt has already secured the premium domain and appointed Phillip Lord, the President of Bakkt International as the CEO of MarushoHotta.

Once shareholders approve the rebrand, the company will change its operations from manufacturing to managing Bitcoin as a part of its balance sheet. Despite the change in direction, MarushoHotta will remain listed on the Tokyo Stock Exchange under its current ticker, TSE: 8105.

Bakkt’s Struggles and the Road to Bitcoin

The drift toward BTC isn’t just an expansion; it’s a lifeline. Bakkt has lost two of its largest clients, including the Bank of America and Webull. These companies made up nearly 91% of two major revenue streams.

Webull’s departure alone caused a 27% drop in Bakkt’s stock, which has plunged more than 96% from its previous high of $1,063 to around $13.

Bakkt is also dealing with NYSE compliance warnings for trading below $1, and threats of class-action lawsuits.

In response, the company recently filed a $1 billion shelf registration with the SEC. This allows the company to raise funds through BTC purchases, convertible notes and equity offerings:

All without having to file individually each time.

Why Japan, Though?

Japan’s has clear and supportive crypto regulations. This could be one of the main reasons why Bakkt chose to enter the market there.

Co-CEO Akshay Naheta described Japan as “an ideal platform for a Bitcoin-centered growth business.”

MarushoHotta’s pivot is similar to moves made by other Japanese firms like Metaplanet, which have achieved major stock gains through aggressive BTC accumulation. By joining this wave, Bakkt hopes Bitcoin.jp will stand among the top corporate holders of Bitcoin.

The Rise of Corporate BTC Treasuries

MarushoHotta’s transformation is part of a much larger movement. Corporations around the world are increasingly putting Bitcoin on their balance sheets to hedge against inflation.

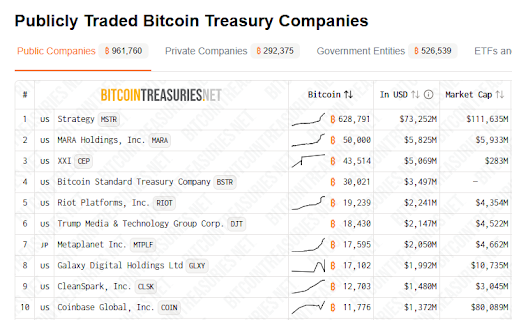

Data from BitcoinTreasuries shows that over 289 companies now hold more than 3.65 million BTC, which is worth around $416 billion. MicroStrategy is leading the pack, but Japan is catching up fast as several Japanese firms are now in the global top 100 for Bitcoin holdings.

This strategy has paid off for many. Metaplanet, for example, has seen its stock skyrocket since adopting a BTC treasury model. MarushoHotta aims to replicate that success under its new brand, Bitcoin.jp.

What’s Next for Bitcoin.jp?

To complete the transformation, MarushoHotta’s shareholders must approve the corporate rebrand towards Bitcoin treasury operations. If approved, the company will officially become Bitcoin.jp, with a full focus on acquiring and managing Bitcoin.

Bakkt’s shelf registration allows it to act quickly based on market conditions. This means that it can seize opportunities to buy BTC when prices are favourable. The flexibility it offers may be an important factor, especially as the firm continues to recover from its most recent financial hits.