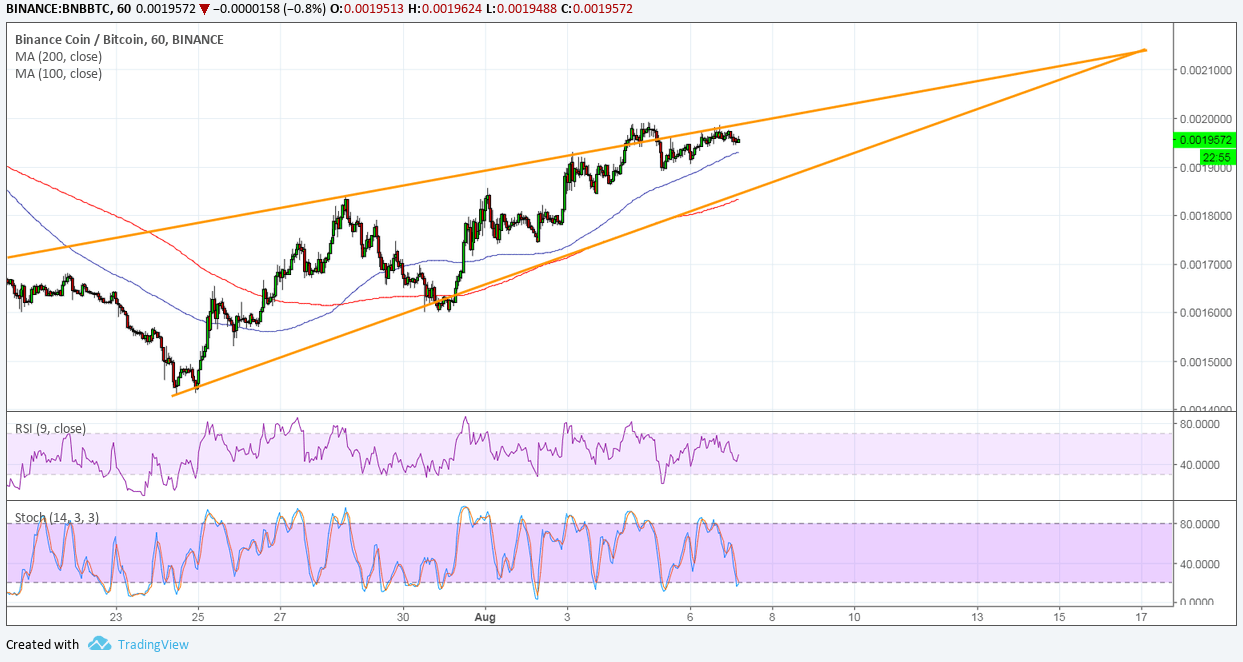

Binance formed higher lows and slightly higher highs to create a rising wedge pattern on its 1-hour time frame. Price is currently hovering at the top of its formation and buyers might be attempting a break higher.

The 100 SMA is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. In other words, resistance is more likely to break than to hold or support is more likely to hold than to break. The 200 SMA dynamic support also lines up with the bottom of the wedge to add to its strength as a floor.

The gap between the moving averages is also widening to signal stronger bullish momentum. However, RSI is on the move down so sellers might still have the upper hand for now. In that case, another test of support may be underway, although it’s also worth noting that the 100 SMA dynamic support is just close by.

Stochastic is also heading down so Binance might follow suit, but this oscillator is already nearing oversold levels to reflect exhaustion among sellers. In that case, bulls might be eager to charge and push price past the wedge top, possibly leading to a climb that’s the same height as the chart pattern.

Binance has remained supported while bitcoin and its peers once again find themselves on rocky ground. However, another boost may be waiting in the wings as Goldman Sachs confirmed that they might consider custody offering for crypto funds. If so, it could mean a big boost in investments in the industry, possibly proving more positive for bitcoin than Binance itself.

Still, Binance has some factors to draw support from, one of which is the news that UPbit has been cleared after investigations into the South Korean cryptocurrency exchange. This could renew support for Binance’s platform itself and its exchange-based token.