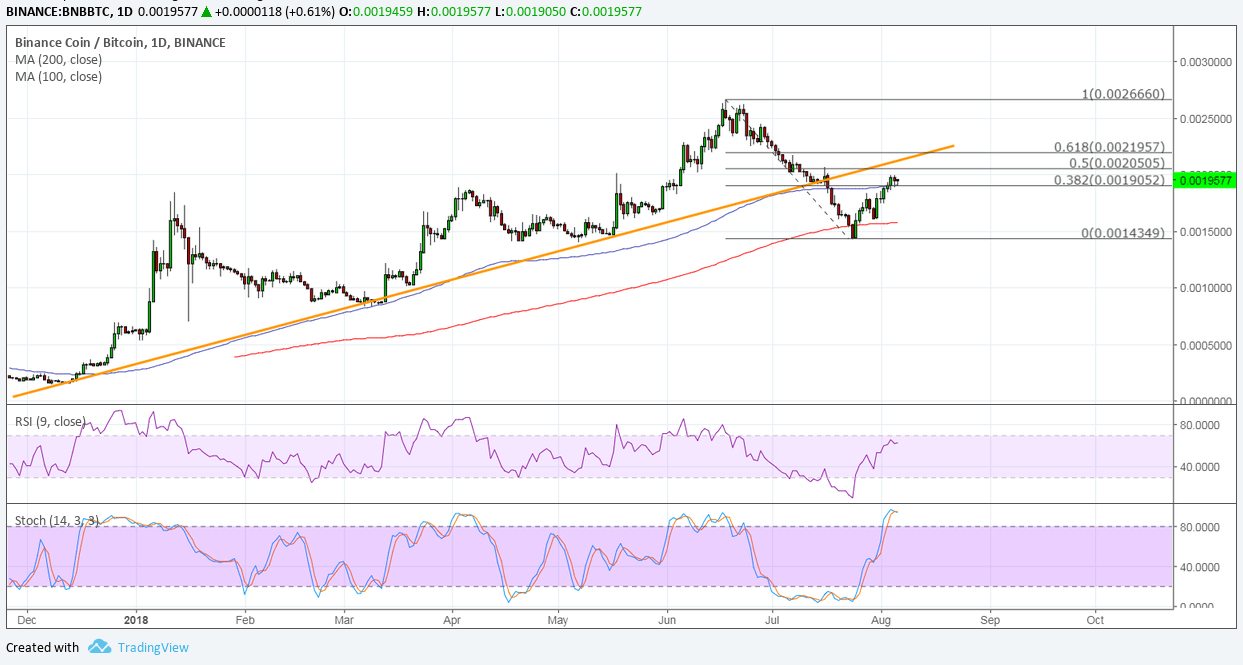

Binance previously broke below a long-term ascending trend line visible on its daily chart, signaling that a major downtrend is underway. Price is in the middle of a pullback, though, but the Fib levels could keep gains in check around the areas of interest.

In particular, the 50% level lines up with the broken trend line around the 0.0020 level and might be enough to push price back down to the swing low. However, the 100 SMA is still above the longer-term 200 SMA to signal that the path of least resistance is to the upside or that the rally is still likely to resume.

Price found support at the 200 SMA dynamic inflection point after all and appears to be moving past the 100 SMA. In that case, there may still be a bit of bullish pressure returning.

RSI is also heading higher so Binance might follow suit. A move past the 61.8% Fib could be enough to signal that bulls are winning out and the uptrend is gaining traction. Stochastic is also moving up but is dipping into overbought territory to indicate exhaustion and a possible return in bearish pressure.

Binance has been raking in some gains as it takes advantage of bitcoin weakness. It did draw support from news that UPBit, a major cryptocurrency exchange in South Korea, was cleared after investigations.

Binance also got a boost when CEO Changpeng Zhao clarified that they are not competing with Coinbase. Earlier on, Binance acquired Trust Wallet, a decentralized crypto wallet service that also features a browser for dApps, which Zhao also clarified that they’re planning to keep it as an independent product line.

In the same interview with Fortune Magazine, Zhao also mentioned:

“In developed markets, there’s more money to be made but more regulation and it’s saturated with competition. We don’t want to compete with Coinbase and Gemini. The strategy there requires lots of lawyers and lobbying.”