After a previous upside break, Binance slumped back to consolidation against bitcoin as the latter regained support. The launch of CBOE bitcoin futures is seen to be the main catalyst as this boosted trading activity and volumes.

On the 1-hour time frame, it can be seen that Binance is trending lower against bitcoin once more, with the moving average holding as dynamic resistance. Stochastic is moving up to suggest a potential bounce but is also nearing overbought levels to reflect exhaustion among buyers.

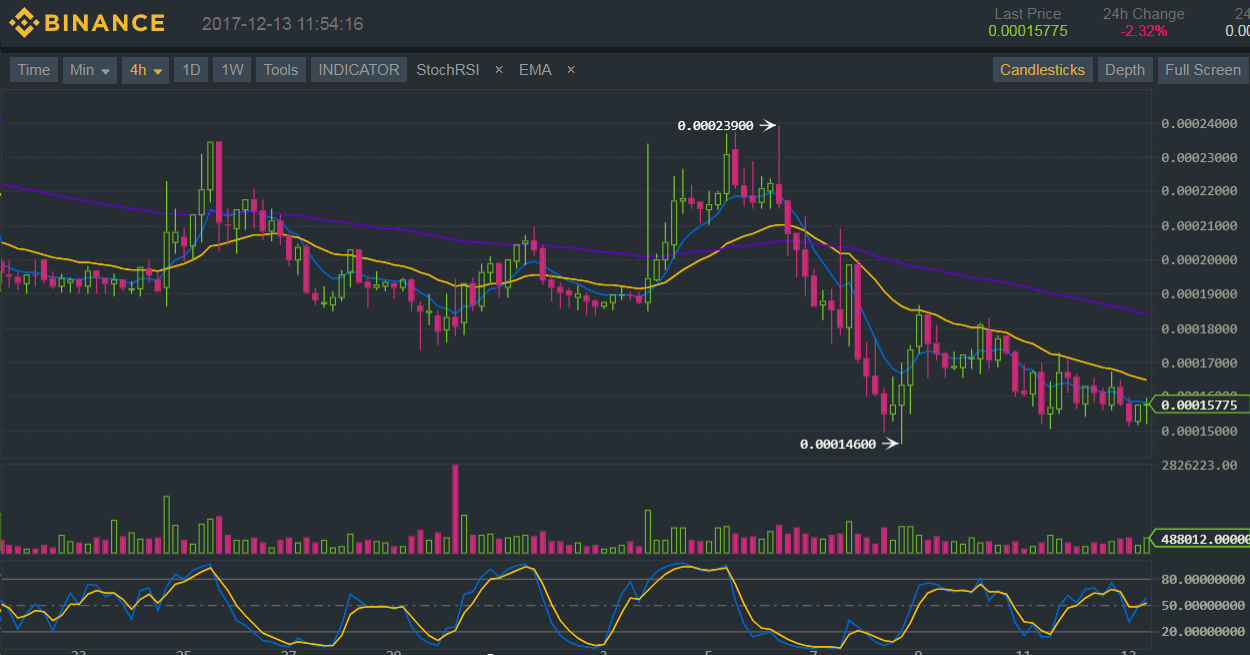

On the 4-hour time frame, it can be seen that price staged a pretty sharp drop a couple of days back. This put Binance below the short-term support at 0.00018 and down to the 0.00015 area. Stochastic appears to be moving sideways to signal further consolidation.

Also, the short-term moving average is below the long-term one to signal a pickup in bearish pressure. If this keeps up, more losses could be in the cards for Binance.

Lastly, the daily time frame reflects a possible descending triangle support break. Recall that the support was somewhere closer to 0.00020 and price is now trading around 0.00015.

Stochastic is still pointing down to show that sellers are on top of their game but is also nearing oversold levels to suggest profit-taking. If this happens, Binance could still pull back to the broken support to gather more selling pressure.

Bitcoin has gained a lot of investor interest leading up to and following the launch of bitcoin futures on the CBOE. CME and Nasdaq are said to be ready to launch their own bitcoin futures soon, which could mean more downside for Binance as traders move their funds.

Note that the triangle spans 0.00070 to 0.00020 so the resulting drop could be of the same height. If this proves to be a fake out, however, Binance could still land back inside the triangle and resume consolidation or go in the opposite direction.