The cryptocurrency market is once again in the red across the board with bitcoin falling below $8,000 during Monday morning trading.

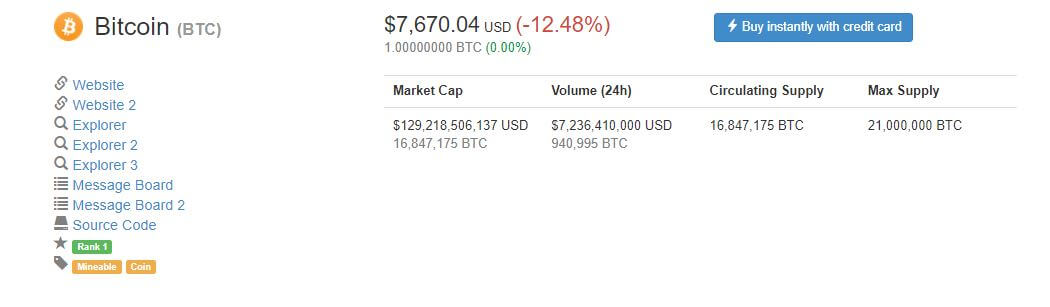

After a tough week last week, the digital currency market remains under pressure. Despite a relatively stable weekend, bitcoin has once again seen its value drop below $8,000, dropping 12.48 percent in 24 hours on Monday, according to CoinMarketCap. It’s currently trading at $7,670.

Similar price drops can be seen across the board. Ethereum is reporting a 13.82 percent decrease over a 24-hour period, whereas third-placed ripple is down in value by 15.06 percent in the same time frame. Ether prices are currently valued at $770 and the XRP token is trading at $0.754238.

Out of the top 100 cryptocurrencies only a handful have produced advantages in their prices either over an hour, 24-hour, or seven day period.

This fall in price for bitcoin, though, represents a 2 1/2 month low, which comes amid fresh concerns about a regulatory clampdown and a ban on cryptocurrency trading.

JPMorgan Chase, Citigroup, and more recently, Lloyds Banking Group have announced the banning of customers from purchasing bitcoin and other digital currencies using credit cards. The banks are worried that lenders will be held liable if the crypto market plunges further in value leaving them with huge debts.

News from Asia is becoming an increasing concern for the cryptocurrency market, which is continuing to impact prices. New reports suggest that China is preparing to block all websites related to digital currency trading and initial coin offerings (ICOs), including those of foreign platforms, in an attempt to stamp out the market completely.

In an article published by the People’s Bank of China-affiliated Financial News, it said, as reported by the South China Morning Post that:

To prevent financial risks, China will step up measures to remove any onshore or offshore platforms related to virtual currency trading or ICOs. ICOs and virtual currency trading did not completely withdraw from China following the official ban … after the closure of the domestic virtual currency exchanges, many people turned to overseas platforms to continue participating in virtual currency transactions.

It added that ‘risks are still there’ with the intention of tightening regulation in the market.

Last week, India’s finance minister Arun Jaitley revealed in his budget speech that ‘the government does not consider cryptocurrencies legal tender … and will take all measures to eliminate use of these crypto-assets in financing illegitimate activities or as part of the payment system.’