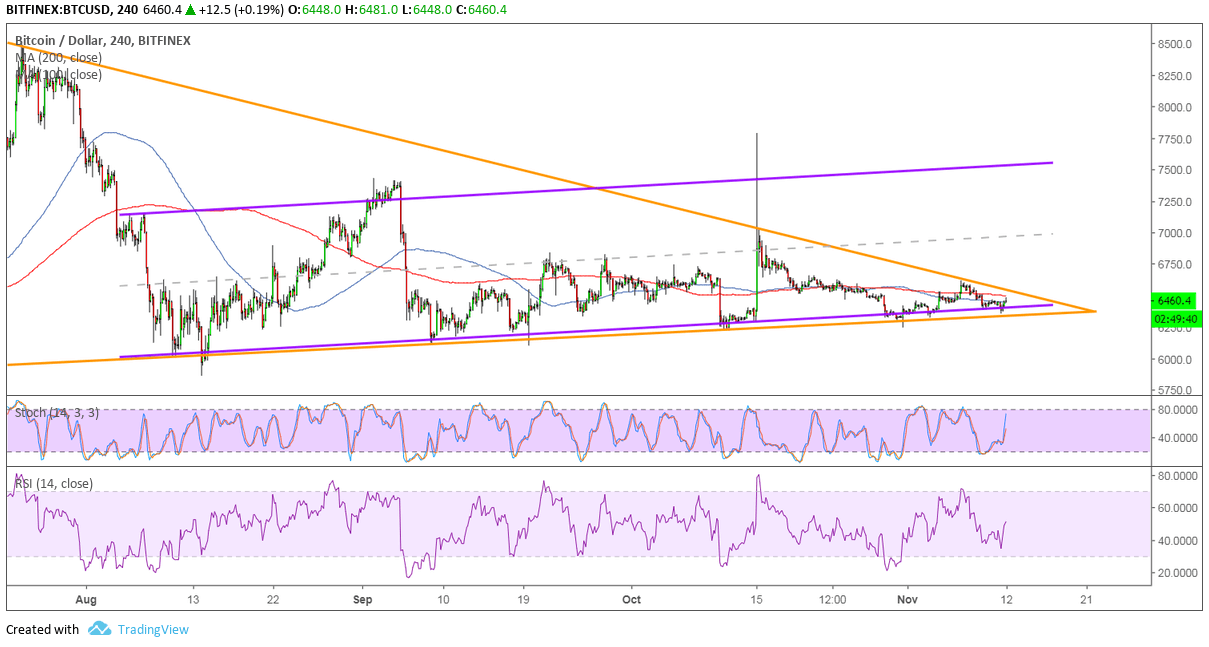

Bitcoin is still keeping its head above the rising channel support seen on the 4-hour chart, but it looks like there’s more hesitation. Price is consolidating inside another symmetrical triangle pattern as it formed higher lows and lower highs recently.

A move past the triangle top around $6,500 could be enough to confirm that bullish momentum is present and that a move to the channel top could take place. The 100 SMA is below the longer-term 200 SMA for now, though, so the path of least resistance might be to the downside. If that’s the case, a move below the triangle bottom and channel support could signal that a downtrend is about to happen.

The chart pattern spans $6,000 to around $8,200 so the resulting move in either direction could be of the same height. Stochastic is pointing up to suggest that buyers have the upper hand for now, so the price might follow suit. This oscillator has a lot of ground to cover before reaching overbought territory, so bullish pressure could still last.

RSI is just pulling higher and has even more room to climb before reaching the overbought zone. This oscillator didn’t even reach the oversold region before turning back up, suggesting that buyers are eager to return. Resistance at the mid-channel area of interest at the $7,000 major psychological mark might also hold.

Bitcoin has had a mostly positive week on account of optimism for more institutional investments, but it returned some of its recent gains on regulatory jitters. The SEC reportedly ended its public comment period on Bitcoin ETF applications, which suggests that a decision could be announced anytime now.

Besides, it has also been reported that traders are moving more funds from exchanges to wallets, perhaps as pre-cautionary efforts while regulators crack down on decentralized exchanges such as EtherDelta last week.

Images courtesy of TradingView