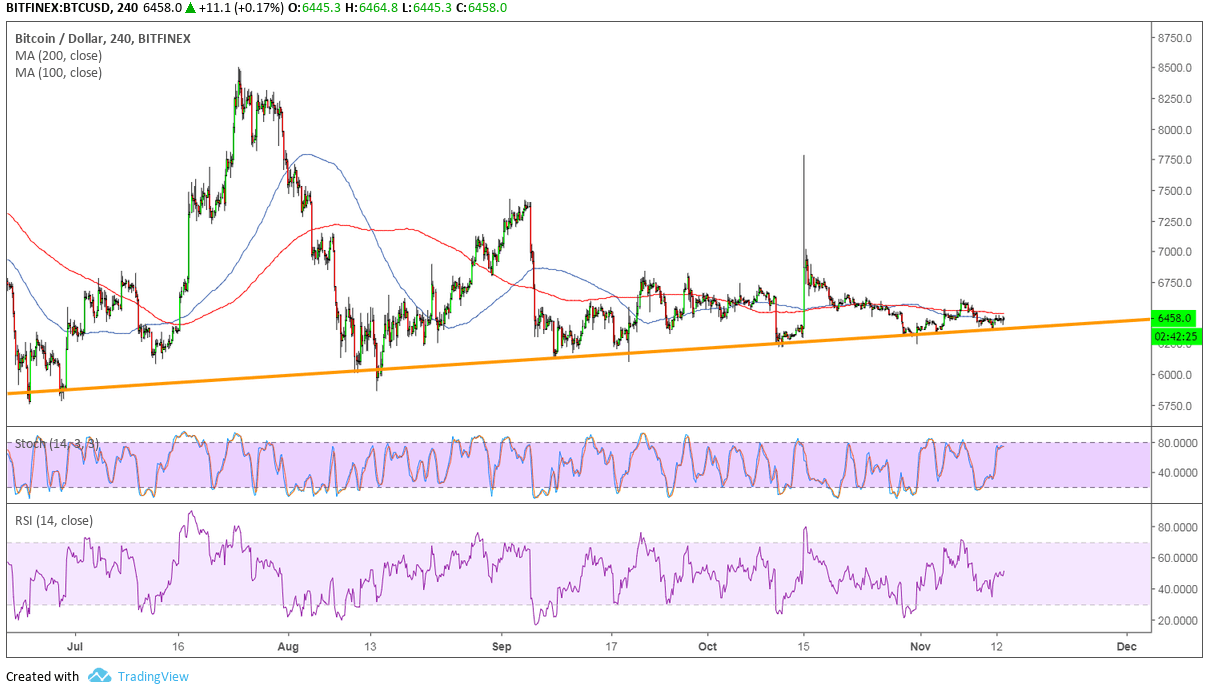

Bitcoin continues to tread carefully above a shallow rising trend line, which also happens to be part of an ascending channel and a symmetrical triangle. Technical indicators are giving mixed signals on where it could head next.

The 100 SMA is below the longer-term 200 SMA to indicate that the path of least resistance is to the downside or that support is more likely to break than to hold. If that happens, Bitcoin could be in for a reversal from its uptrend. These moving averages also seem to be holding as dynamic resistance for the time being.

Stochastic is heading higher to signal that buyers have some energy left, but the oscillator is also nearing the overbought zone to signal exhaustion. Turning back down could lead to a pickup in selling pressure and a break below the support area around $6,400.

Meanwhile, RSI has been on the move down but is changing its mind and turning higher without hitting the oversold region. This suggests that buyers might be eager to return from here.

Analysts remain mostly bullish on Bitcoin, calling this consolidation the calm before the storm as the price is expected to climb to new highs by the end of the year or early next year. This is mostly due to anticipation for institutional investment, starting from Fidelity’s platform for bitcoin and ethereum.

Traders are also holding out for the SEC decision on Bitcoin ETFs as this could also usher in more volumes. The regulator just recently decided to close its public comment period for the applications, which suggests that a decision is due anytime soon. Approval could lead to a big boost for Bitcoin while rejection could be seen as a temporary setback.

Binance CEO Changpeng Zhao told CNBC in an interview that he expects a crypto bull run to happen. Shapeshift CEO Erik Voorhees also said that bitcoin could moon on account of rising US debt.

Images courtesy of TradingView