Bitcoin price continued its hike throughout last week’s trading sessions recording another historical high of $2,319, as this article is being written, on Bitfinex. Around $500 gain in price has been recorded within less than a week. At these unprecedented high price levels, volatility rises too, increasing the risk of investment in the BTCUSD market. According to data from blockchain.info, the 24 hour BTCUSD volume has just recorded a historical high of 295,717,000 USD on major bitcoin exchanges (look at the below chart), which reflects increased interest of the public in bitcoin like never before.

Disclaimer: At such unprecedented high price levels, trading bitcoin can be extremely risky, so trade with caution, avoid leveraged trading and as always, only trade what you can afford to lose

Market Still Bullish On the 4 Hour BTCUSD Chart:

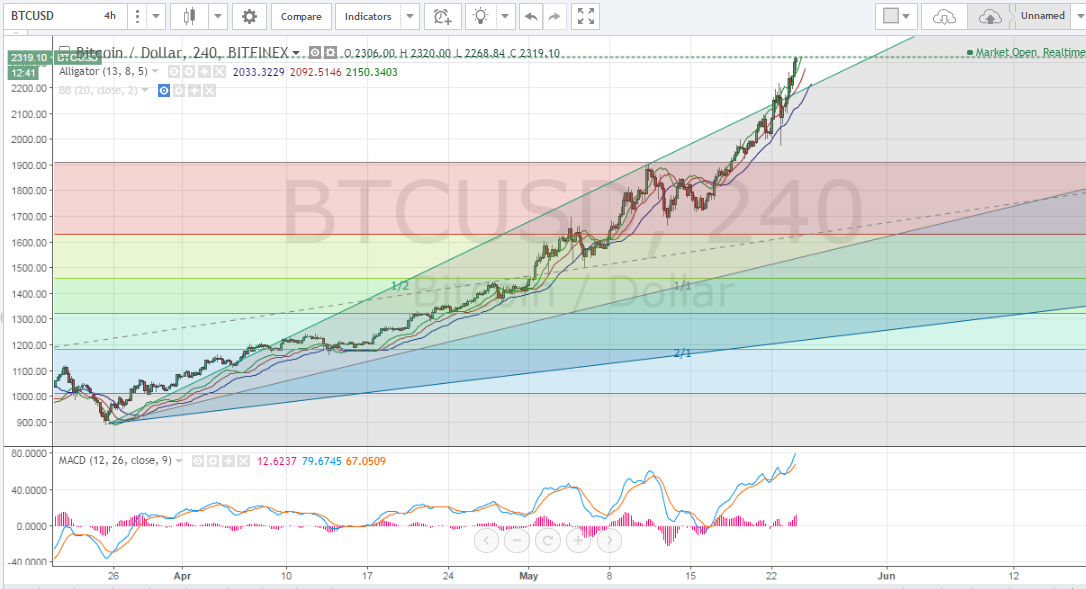

Let’s take a look at the BTCUSD 4 hour chart from Bitfinex, while keeping the Fibonacci retracement levels we plotted during last week’s analysis and executing the MACD indicator and Williams Alligator indicator (look at the below chart), we can notice the following:

- We can plot Gann angle placements between the low recorded on the 25th of March ($887) and the high scored on the 11th of May ($1909.37). As shown on the above chart, bitcoin price is now moving above the 1 x 2 Gann angle. At such high levels of rise, the market is unstable, so we expect to see price drop so candlesticks would start forming below the 1 x 2 Gann angle.

- The smoothed moving averages (SMAs) of the Williams Alligator indicator are still exhibiting a bullish signal with the green SMA above the red SMA and the blue SMA is below both. This bullish signal has been present since May 16th, so we expect price to continue on surging.

- The MACD indicator is showing a bullish signal, denoting continuation of the current bullish run. The MACD indicator values around 80 at the moment with the positive blue trend line moving above the negative red trend line and both of them are in the positive territory.

Conclusion:

Bitcoin price continued on rising to score another historical high of 2,319 USD at the time of writing of this analysis. Our technical analysis is in favor of continuation of the bullish run that has been controlling the market during the past month or so; however, a minor downwards price correction wave can occur to stabilize the market and take the chart down below the 1 x 2 Gann angle, before we can see price rise to even higher levels.

BTCUSD Chart from Bitfinex, hosted on Tradingview.com.

24 hour BTCUSD trading volume chart from Blockchain.info