Chainlink has launched privacy-preserving technology for institutions, bagging ANZ Bank as a client.

Decentralized oracle network Chainlink has launched private transaction capabilities for institutions wanting to harness blockchain technology while upholding total privacy. The platform will offer interoperable transaction capabilities, allowing financial entities to connect their private blockchains with enterprise-related backend solutions while limiting onchain data exposure.

“We’re excited to introduce two new privacy-preserving capabilities of the Chainlink Platform, and an update to an existing capability, that enables financial institutions to maintain data confidentiality, data integrity, and support regulatory compliance when transacting across the multi-chain economy,” Chainlink mentioned in an announcement.

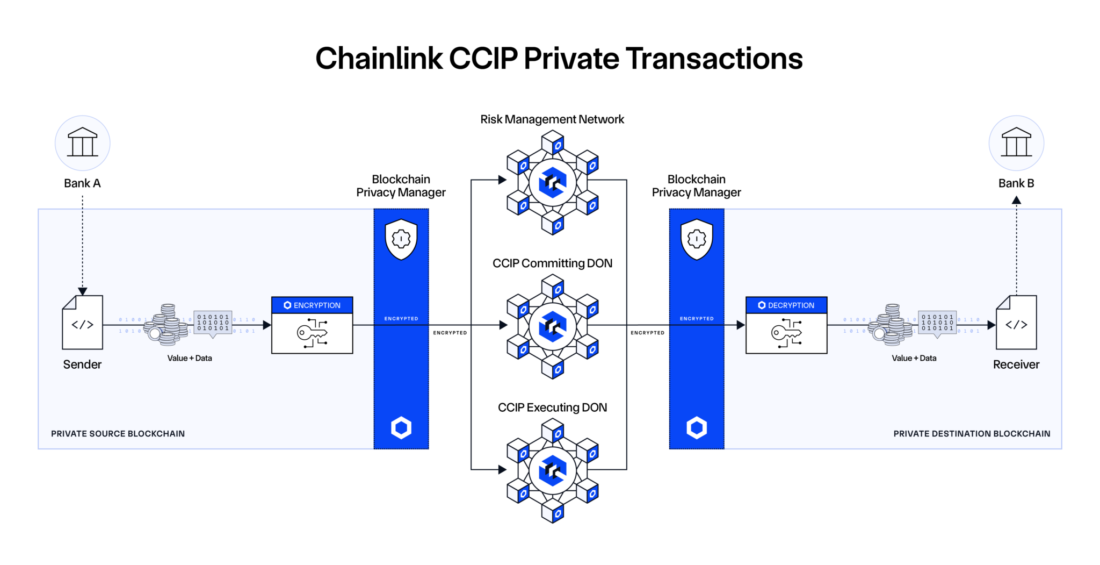

Called the Blockchain Privacy Manager, the tech will allow institutions to utilize Chainlink’s offerings like “Proof of Reserves (PoR), Net Asset Value (NAV), prices, and identity data” while not leaking any information. Furthermore, the entities can also connect their private chains with public chains using the Chainlink Cross-Chain Interoperability Protocol (CCIP). Despite connecting to public networks, institutions can choose what information they want to share using the platform’s privacy tech.

Source: Chainlink

Source: Chainlink

“End-to-end encryption prevents Chainlink node operators or other third parties from accessing the sensitive content of institutional cross-chain transactions, including token amounts, sender/receiver addresses, and data instructions,” the announcement explained. “Encryption keys are generated and held by institutional users and can be selectively shared with authorized parties of their choice, such as counterparties, compliance auditors, or financial regulators.”

With that, Chainlink allows institutions to remain compliant with financial regulators while maintaining privacy from the public. This solution could finally bridge the gap between TradFi giants and blockchain technology. For instance, blockchain technology operates with total transparency—a crucial ethos for decentralization. However, that hinders adoption, as jurisdictions like the European Union (EU) impose stringent data privacy laws. This solution will allow entities to comply with the bloc’s General Data Protection Regulations (GDPR).

ANZ Bank Partners With Chainlink to Utilize the Technology

That possibility has already got big names signing up for Chainlink’s new offerings. In an X post, the oracle network mentioned, “Australia and New Zealand Banking Group (ANZ) will be among the first financial institutions to pilot the capability for cross-chain settlement of tokenized real-world assets (RWAs) under the Monetary Authority of Singapore (MAS) Project Guardian initiative.”

“We are excited to continue our collaboration with ANZ and explore how to make large transactions across multiple chains in a way that helps meet their compliance and legal requirements, enabling their entry into the market and the growth of the entire blockchain industry through their exciting participation,” said Chainlink co-founder Sergey Nazarov in a release.