The DeFi Edge protocol announced delisting certain contracts last month but has now paused deposits for all its strategies.

Automated liquidity provision and yield optimization protocol DeFi Edge stopped deposits on all its contracts on October 14, preventing users from indulging in its strategies to earn returns.

Late last month, DeFi Edge took to X to let users know it would delist multiple strategies from its platform. Now, it has blocked all contracts, preventing users from indulging in more contracts than previously mentioned. However, withdrawals are still being processed despite the protocol asking users to pull their funds out by October 10.

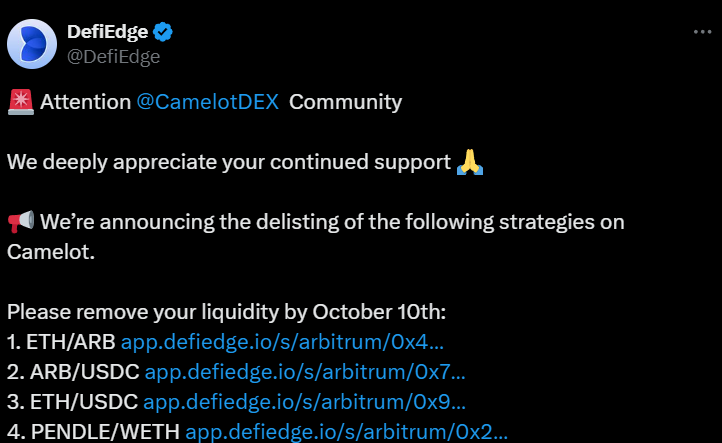

The protocol announced on September 30 that it is delisting certain strategies used for accruing value from the Camelot exchange deployed on the Ethereum layer-2 Arbitrum. Users were asked to pull their funds out from said strategies by October 10. It displayed a total value locked (TVL) of about $5 million on September 29, a day before it made the Camelot-related announcement.

Source: Defi Edge

On October 4, the BNB Chain deployed PancakeSwap announced that DeFi Edge would stop halting the Position Manager vaults contracts operating on its platform. “@DeFiEdge will stop maintaining all its Position Manager vaults on PancakeSwap from 10 Oct 2024,” adding, “Please remove your funds from their vaults before that to avoid any issues.” The post also mentioned that while withdrawals would be available post October 10, the contracts would not be actively managed.

“Attention PCS LPs, we will be delisting and stop managing the strategies from 10th October 2024,” said DeFi Edge, confirming PancakeSwap’s announcement. “We urge you to remove your liquidity using PCS UI before 10th October.”

All Users Are Yet to Reclaim Their Funds

Many users with their funds in these contracts are yet to act. They collectively have about $2.64 million locked in the strategies as of October 14, according to DeFiLlama. While DeFi Edge made the announcement, many of its users may not be in the loop as the dApp does not mention anything about withdrawals.

DeFi Edge is used by those wanting to provide liquidity to DEXs to earn rewards but not wanting to manage certain aspects like rebalancing the assets in the pools they are locked in and claiming fees. The protocol offers its users convenience by automating such processes. It is integrated with numerous DEXs like PancakeSwap, Camelot, Thena, QuickSwap, Lynex, and more.