What is Bitcoin? The answer is pretty simple, it is a type of decentralized cryptocurrency. However, governments are thinking of a completely different definition altogether. They want to know whether they should classify it as currency, commodity or money and find ways to tax bitcoin transactions.

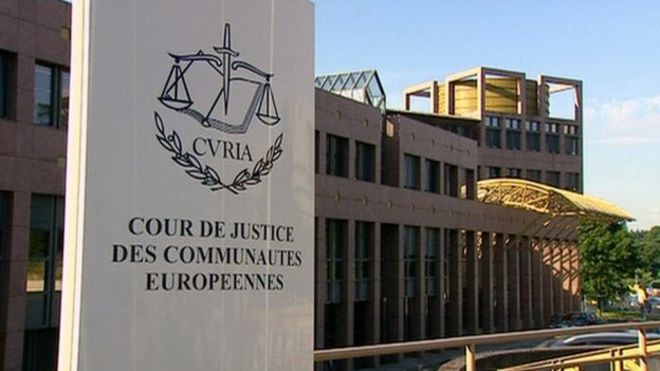

In European Union, the governments are waiting for the European Court’s decision on whether bitcoin exchanges should come under the purview of VAT (Value Added Tax) or not. The European Court is expected to decide upon the status of VAT on bitcoin trades on Thursday. The dispute was carried over from Swedish Court after its decision to exempt bitcoin trade from VAT didn’t go well with the country’s taxation authority – Skatterverket.

The Swedish court handled the enquiry on whether bitcoin trade should be taxable under VAT after one of the residents who wanted to start a bitcoin brokerage firm requested for policy clarification. The court after considering the case decided that bitcoin trade is not eligible for VAT. At present, the outlook seems good for bitcoin exchanges as the probability of European Court of Justice ruling in favor of bitcoin is high. This is further strengthened by the recent recommendation by Juliane Kokott, the Court Advocate General who had mentioned that VAT should not be applicable for bitcoin exchanges.

This is not the first time that people are caught in confusion due to the highhandedness of government organizations. In United States, recently the Commodity Futures Trading Commission classified bitcoin as a commodity and hence bitcoin derivative markets will have to adhere to the regulations set by CFTC. Similarly bitcoin is also considered as money, currency and property for various reasons by different government agencies in order to maximize the revenues generated in the form of taxes and regulatory fees.

The decision of European Court of Justice on Thursday will decide the fate of bitcoin in European Union.