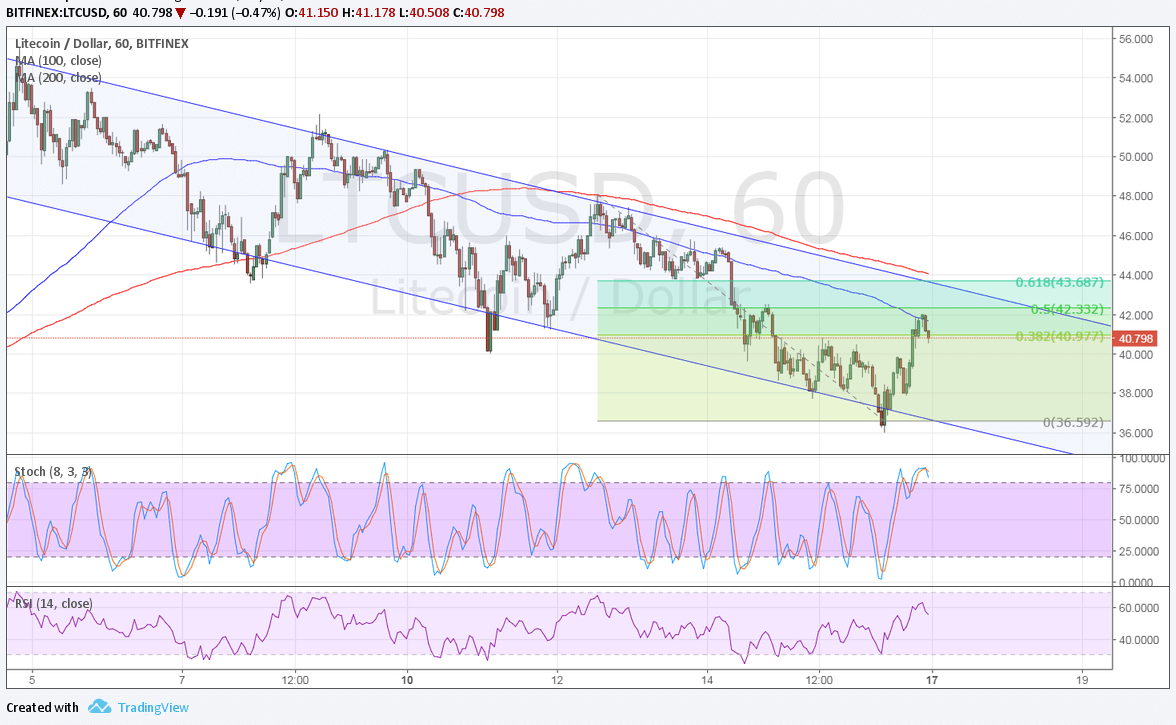

LTCUSD is trading inside a bearish channel pattern connecting the highs and lows since the start of July. Price just bounced off the descending channel support and is in the middle of a correction to the resistance.

Applying the Fibonacci retracement tool on the latest swing high and low on the 1-hour time frame reveals that the 61.8% Fibonacci retracement level coincides with the channel resistance just below the $44 level. This also lines up with the longer-term 200 SMA dynamic inflection point.

The 100 SMA is below this longer-term 200 SMA so the path of least resistance is to the downside. This moving average is also in line with the 50% Fib and is holding as dynamic resistance. If it continues to keep gains in check, LTCUSD could resume its drop to the swing low at $36.59 or until the channel support.

Stochastic is already indicating overbought conditions to signal that buyers are tired. RSI is on the move up but looks ready to turn lower in order to signal a pickup in selling pressure. Once both oscillators start heading lower, LTCUSD might follow suit and even attempt to break below the channel support to establish a deeper selloff.

Cryptocurrencies have been on the decline these days as analysts keep pointing out that the speculative bubble is about to burst. However, the dollar also weakened against its peers on Friday when data turned out weaker than expected.

Headline CPI posted a flat reading instead of the estimated 0.1% gain while the core reading showed a 0.1% uptick versus the projected 0.2% increase. Headline retail sales slid 0.2% to reflect weaker consumer spending while the decline in the UoM consumer sentiment figure hinted of even slower spending down the line. All in all, these signaled that the slowdown in spending in inflation and spending are not as temporary as the Fed assessed.

Still, the factors weighing on bitcoin and other digital assets look like they’re here to stay. Risk appetite has also picked up in global markets to draw traders back towards traditional stocks and commodities as these have been on a tear.