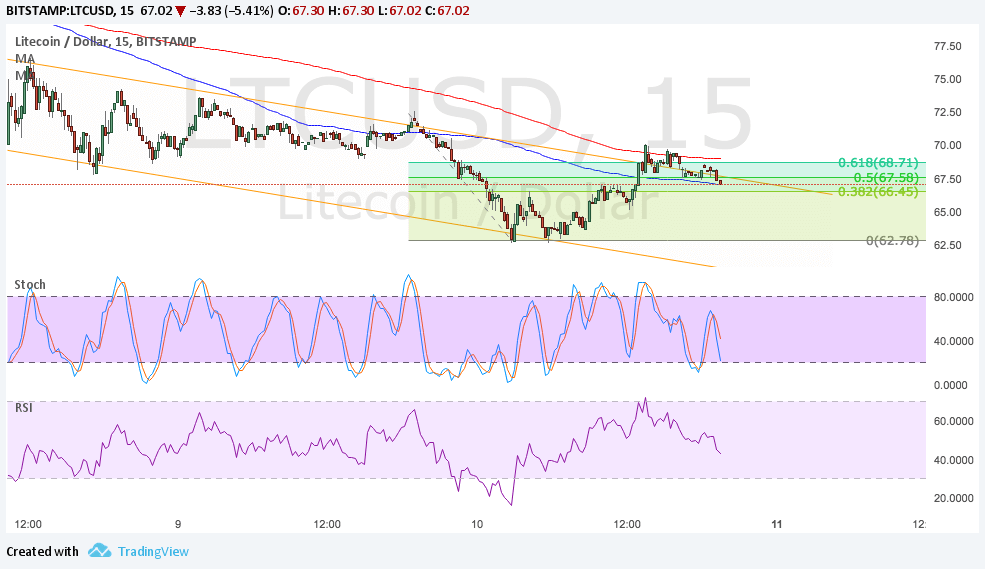

LTCUSD has been trending lower and is currently inside a descending channel on its 15-minute chart. Price is testing the top of the channel around 67.50, which lines up with several resistance levels.

Applying the Fibonacci retracement tool on the latest swing high and low shows that the 61.8% level lines up with the top of the channel, adding to its strength as resistance. The 100 SMA is below the longer-term 200 SMA to signal that the path of least resistance is to the downside, which means that the selloff is more likely to resume than to reverse. The 200 SMA is also around the top of the channel, adding an extra layer of defense.

Stochastic is pointing down to show that bearish pressure is in play. RSI is also on the move down so LTCUSD might follow suit while sellers remain on top of their game. Price could fall until the swing low at 62.78 or until the channel support closer to 62.00.

Cryptocurrencies tumbled on Friday when China announced that it would be shutting off several exchanges, leading many to worry about a likely dip in holdings and trading activity. Liquidation of positions also weighed on LTCUSD price but there has been a considerable correction over the weekend.

Factors that normally boost cryptocurrencies like LTCUSD don’t appear to be around at the moment as tensions with North Korea have subsided. There has been no update from Pyongyang over the weekend but the new set of sanctions being drafted up could trigger a violent reaction at some point.

Meanwhile, the dollar is also under pressure on weaker Fed rate hike expectations. This week’s set of CPI and retail sales figures could be the last piece of the puzzle in confirming that the Fed would sit on its hands for the remainder of the year as a handful of FOMC members already warned about weak underlying inflation and the dangers of tightening too soon.