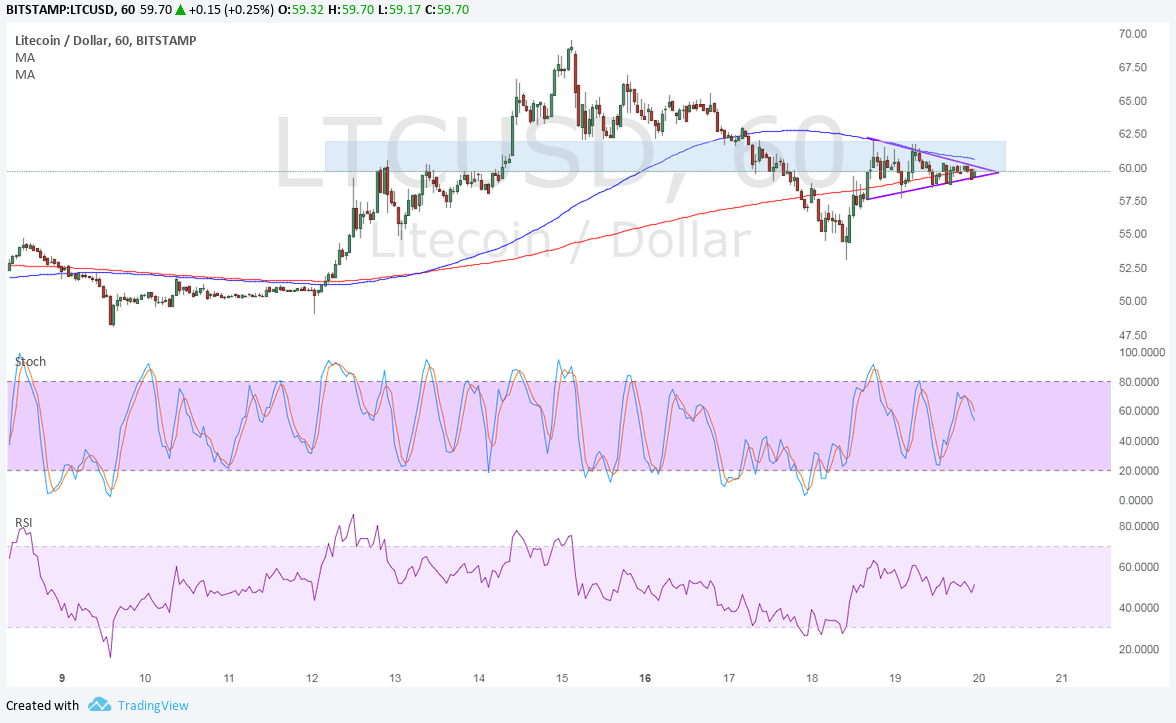

LTCUSD is consolidating in a short-term symmetrical triangle or flag pattern as traders await more catalysts. Price is also hovering around an area of interest which appears to be holding as resistance for the time being.

A downside break from the 60.00 level could be enough to confirm that bearish pressure is in play and that a move towards the lows around 55.00 could take place. This would then form a head and shoulders pattern that is a classic downtrend signal.

Of course price has to break below the neckline at 55.00 before confirming the longer-term selloff, which might last by around 15.00 or the same height as the chart formation. The 100 SMA is still above the longer-term 200 SMA to show that the path of least resistance is to the upside. However, the gap is narrowing to signal that a bearish crossover is due.

Stochastic is turning lower to show that sellers are regaining the upper hand even without hitting overbought levels. RSI also looks ready to head south so LTCUSD might follow suit.

Cryptocurrencies are enjoying some support from the presence of geopolitical risks, particularly those stemming from uncertainties in Spain, Austria, and New Zealand. However, stronger catalysts could be needed to sustain the climb in LTCUSD.

The dollar is also waiting with bated breath to find out who the next Fed Chairperson might be. Trump has had his sit-down with Yellen but there haven’t been much updates on this, signaling that he’s still leaning towards appointing dovish candidate Powell. Stanford alum John Taylor is also a contender and he is seen to be more hawkish option.

For now, LTCUSD could continue to tread sideways until there is a bit more clarity but the persistence of uncertainties in the financial markets could eventually give way to stronger bullish momentum. Traders are also on the lookout for any updates surrounding the bitcoin upgrade as this could impact overall sentiment in the cryptocurrency market.