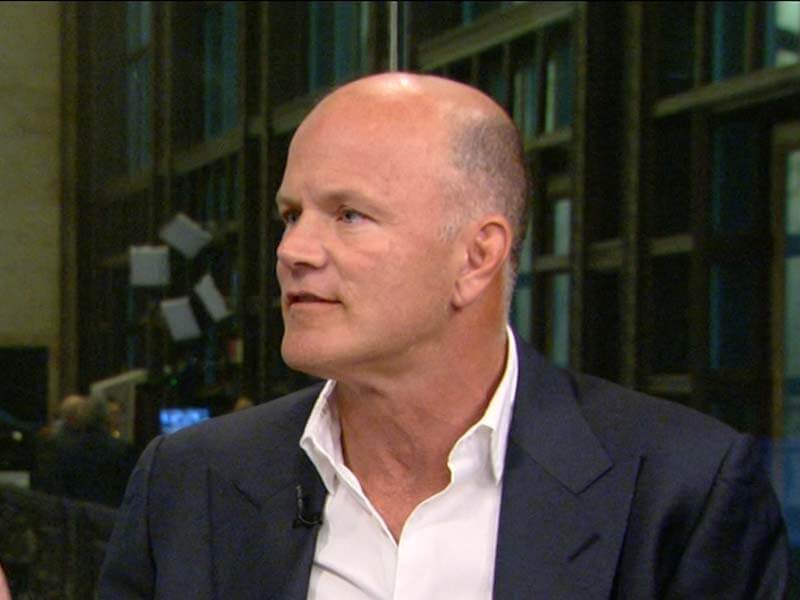

Mike Novogratz – the billionaire investor and head of hedge fund Galaxy Digital – has stated that if Jerome Powell and the Federal Reserve give up the fight against inflation, bitcoin could likely exceed all expectations and rise back up through the roof.

Mike Novogratz Wants to Save Bitcoin

In an interview, Novogratz commented:

If he gives up this fight, you’re going to see bitcoin and other assets take right back off.

Inflation is at a 40-year high in countries like the United States. The disastrous policies implemented by Joe Biden and his dimwitted cronies have caused the stellar economy once overseen by President Donald Trump to retract into one of the biggest slumps on record. The prices of food and fuel have skyrocketed to numbers nobody could have anticipated and working-class citizens are struggling just to afford basic needs.

In response to the inflation, the Federal Reserve has repeatedly implemented rate hikes, though the process hasn’t done much to solve the problem. Rather, things have only been exacerbated in many ways. Americans now can no longer afford homes, cars, or other large items that are necessary for everyday life, and assets like bitcoin – having previously achieved new all-time highs (i.e., bitcoin reached $68,000 in November of last year) – have come crashing down.

The country is at a bit of a crossroads in that while the fight against inflation has thus far produced virtually no visible results, the fight needs to continue as everyday citizens cannot deal with the rising prices in question. They are running the risk of falling below the poverty level, which is likely to lead to even more negative results for the nation.

But Novogratz is confident that the fight against inflation isn’t going to do anything, and that the Fed needs to stand aside and let the negative economic trends take their natural toll. He believes that if the Fed can just step away for a bit, assets like bitcoin could potentially return to form, and that this would arguably be a much stronger maneuver for the people of America. He said:

When Powell started beating inflation over the head with a sledgehammer, of course bitcoin came back down, as did lots of assets.

The Crypto Market Has Really Been Hit Hard

Over the last year alone, bitcoin has lost close to 80 percent of its value. The asset was trading at $68,000 in November of 2021. This was a new record for the world’s primary digital currency, and many felt that the asset was unstoppable at the time. Nobody could have predicted that just 11 months later, the virtual currency would get swallowed up by bears intent on destroying all the gains of the previous two years.

In all, the crypto space has lost more than $2 trillion in valuation since the beginning of 2022.