Even though the utilization of bitcoin is not popular enough to impose considerable impact on the global mainstream economy, as a virtual currency built via the blockchain protocol, the advent of bitcoin offers us a myriad of beneficial ideas of online financial development.

Today, the number of bitcoin trading platforms based in China exceeds 20, among which are BTC-e, BTC China, OKCoin, BtcTrade, Huobi.com and BtcTradeChina. According to numerous media reports, more than 30% of the bitcoin traded in the whole world originates from China. Nevertheless, Bitcoin’s legal status is still unclear in China. On the other hand, in the US many bitcoin trading platforms have already acquired FinTech licenses, while the Chinese government is still adopting a rather ambiguous attitude towards the blockchain technology and bitcoin. For the time being, the People’s Bank of China, i.e. the Chinese Central Bank, considers bitcoin a form of “virtual good”, so it does not include it in legislation regulating financial assets. This lacking definition of bitcoin led to the absence of laws, which furthers policy uncertainty that characterizes bitcoin markets in China. When market performance is considered, the price of bitcoin is highly volatile across Chinese markets, as shown by the below BTCRMB chart from BtcTrade.

A recently published paper closely examined the price performance and volatility of bitcoin across both the Chinese and US markets. The researchers used data from May 8, 2015 all the way through to Sep 30, 2016. Bitcoin price in Yuan was obtained from Btctrade.com and USD price data was obtained from Blockchain.info. USDRMB exchange rate data was obtained from the Chinese CSMAR database.

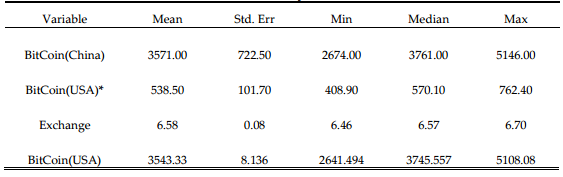

Bitcoin(USA) is a parameter that is formulated to represent the value of the US market by denominating it in bitcoin. It is calculated by multiplying the price of bitcoin in USD by the USDRMB exchange rate. The below table shows the summary of the statistics of the data obtained:

The study relied on Recursive’s Ganger test, in addition to Rolling Ganger test to test the price discovery in both the US and Chinese markets. Moreover, Johansen’s test was used to test the cointegration relationship that exists between Bitcoin (USA) and Bitcoin (China). The results of these testing methods proved that there is a long term cointegration relationship existing between Bitcoin (China) and Bitcoin (USA). Moreover, further analysis of the results proves that the Chinese market plays a crucial role in price discovery in US markets, i.e. BTC (USA). In other words, the Chinese market has a bigger influence on the US market, which goes hand in hand with the home bias theory.

The paper also attempted to discover the pattern of volatility transmission across the US and Chinese markets, via utilizing the BEKK model along with ECM in the form of a horizontal equation. The results of this analysis shows that transmission of volatility is likely to originate from the US market to affect the Chinese markets; this finding greatly endorses the global center hypothesis.

Chart from BTCTrade