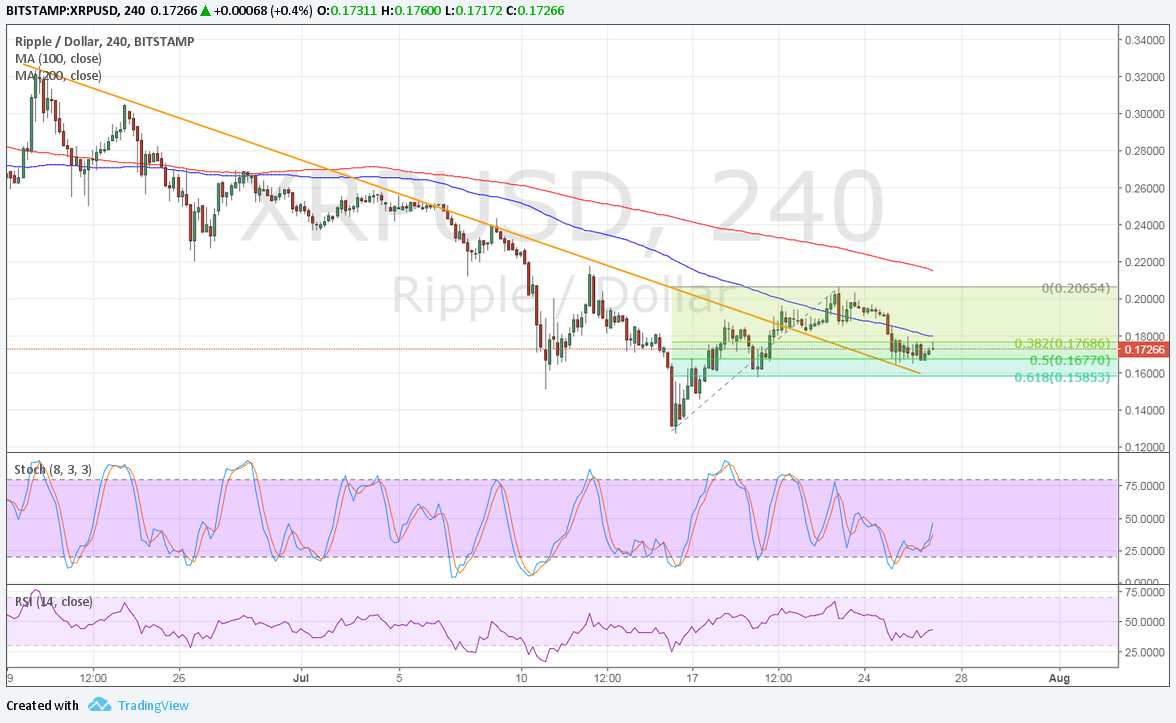

Ripple recently broke above a short-term descending trend line connecting the highs of price action since last week. Price zoomed up to test the 0.2000 barrier but has pulled back to retest the broken resistance.

Applying the Fib tool on the latest swing low and high shows that the 50% level lines up with this broken resistance level, adding to its strength as support. If it continues to hold, Ripple could bounce back to the swing high or start an uptrend.

In fact, a test of the swing high could complete the formation of an inverse head and shoulders pattern, which is a classic reversal signal. Price still has to break past the neckline at 0.2000 to confirm that an uptrend is underway and this resistance is close to the 200 SMA dynamic inflection point.

Speaking of moving averages, the 100 SMA is still below the longer-term 200 SMA so the path of least resistance is to the downside. In other words, the downtrend is more likely to resume than to reverse. The widening gap between the two moving averages also suggests that bearish pressure is accelerating. Also, the 100 SMA recently held as dynamic resistance and might continue to do so if bears don’t let up.

Stochastic is pulling up from the oversold area, though, to signal a return in bullish momentum. RSI also seems to be turning higher so Ripple might follow suit. The reversal pattern spans 0.1300 to 0.2000 so the resulting climb could be of the same size, possibly taking Ripple to 0.2700.

Sentiment in the cryptocurrency market seems to be taking its cue mostly from bitcoin developments. Last week, enthusiasm over the BIP 91 lock-in drove bitcoin to test its all-time highs but the resurgence of other versions of the software earlier this week kept hard fork concerns in play. Investors are turning their attention to August 1 to see if the network has managed to give consensus support to the SegWit upgrade, and prices could tumble if not.