IOTA is consolidating against bitcoin and the dollar, moving inside a symmetrical triangle against the former. Price appears to be attempting a downside break, though, likely taking price down the same height as the chart formation.

The 100 SMA is above the longer-term 200 SMA on the 1-hour time frame so the path of least resistance might still be to the upside. In addition, the moving averages are holding as dynamic support levels.

Also, stochastic is indicating oversold conditions or that sellers are exhausted. RSI is also dipping into oversold territory to indicate weaker bearish momentum and a potential return in buying pressure. In that case, IOTA could still bounce back to the top of the triangle against bitcoin.

Besides, bitcoin seems to be regaining a bit of ground to start the year, taking advantage of dollar weakness and the success of the latest network upgrades. A few more are scheduled until March 2018, likely rendering the core version superior than its rivals like bitcoin cash.

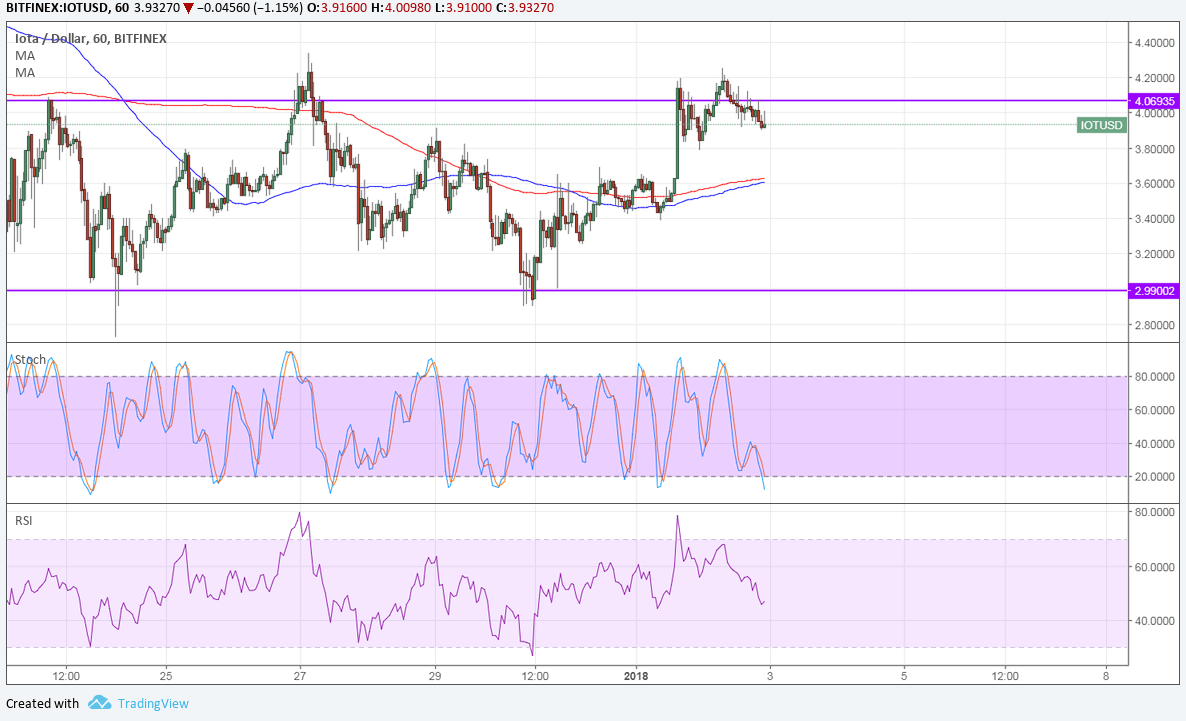

Against the dollar, IOTA is pacing back and forth inside a range. Price is currently testing the resistance and could be due for a drop back to support if it holds.

The 100 SMA is below the longer-term 200 SMA, so the path of least resistance is to the downside. Stochastic is also pointing down to show that sellers have the upper hand while RSI has more room to drop, which suggests that bears could stay in control for a bit longer.

Price could find support either at the middle of the range near the moving averages around 3.5000 or the very bottom closer to 3.0000. The dollar has the NFP lined up later in the week and the upcoming release of the FOMC minutes should also provide some volatility.

In particular, traders are on the lookout for clues on how the Fed tightening pace might go this year, with downbeat remarks likely weighing on expectations and demand for the currency.