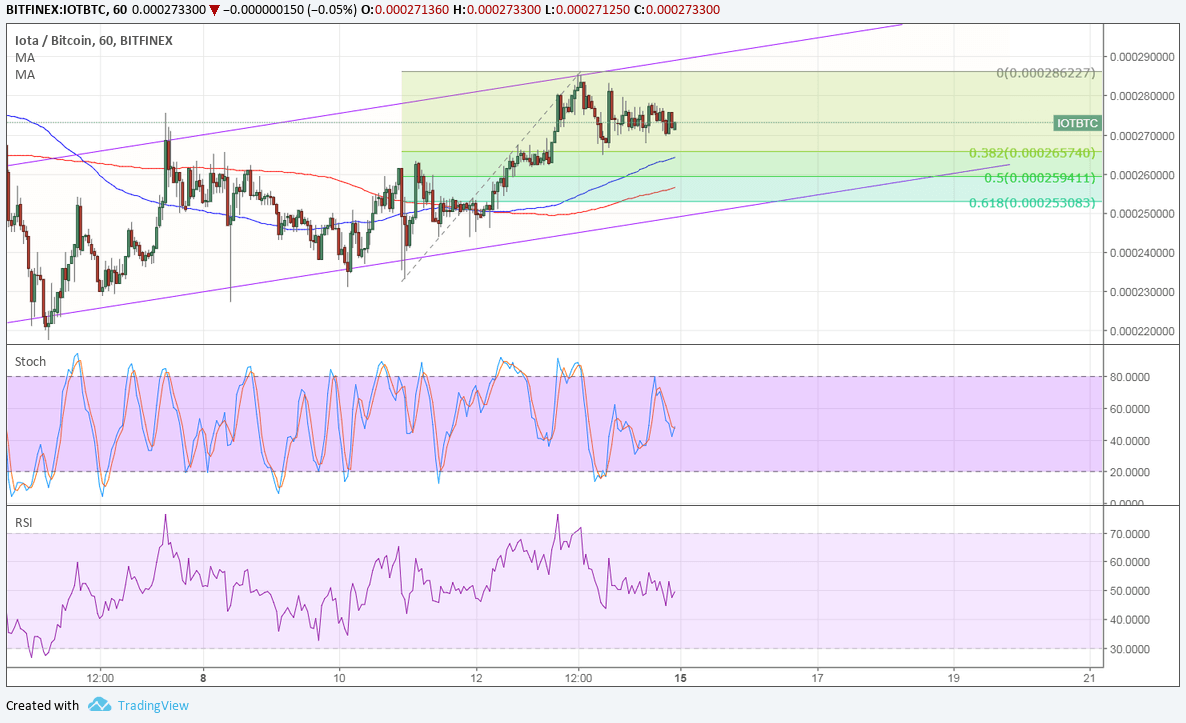

IOTA continues to advance against bitcoin and might also be due for a stronger bounce to the dollar. On the 1-hour time frame of IOTBTC, an ascending channel can be seen and price appears to have bounced off the 38.2% Fibonacci retracement level.

A larger correction, however, could still last until the 61.8% Fib right at the bottom of the channel and near the 0.00025 level. This is close to the 200 SMA dynamic inflection point, which might be the line in the sand for the short-term uptrend.

The 100 SMA is closer to the 38.2% correction level and is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. In other words, the uptrend is more likely to continue than to reverse. In that case, IOTA could test the channel resistance around 0.00030 or the swing high just below the 0.00029 level soon.

Stochastic on the move down on this time frame, though, and RSI looks ready to head south as well. This suggests that selling pressure is present and that the correction could go on for a while.

Against the dollar, IOTA is also on an uptrend and is just bouncing off the bottom. A small double bottom pattern can be seen and price has already broken past the formation’s neckline to confirm that a climb is due.

Price is pulling back to the broken neckline near the 38.2% Fibonacci retracement level. A larger pullback could last until the 61.8% Fib near the channel support at 3.45.

Stochastic is also pointing down on this time frame to suggest a return in bearish pressure while RSI is on the move up. A return in bullish momentum could lead to a climb up to the swing high close to 4.000 or to the channel resistance all the way up at 5.000.

The dollar has gained some support from upbeat core US CPI released on Friday, which revived Fed tightening expectations for the year. There’s not much in the way of top-tier data today, but the earnings season has kicked off and more equity gains could be dollar bullish.