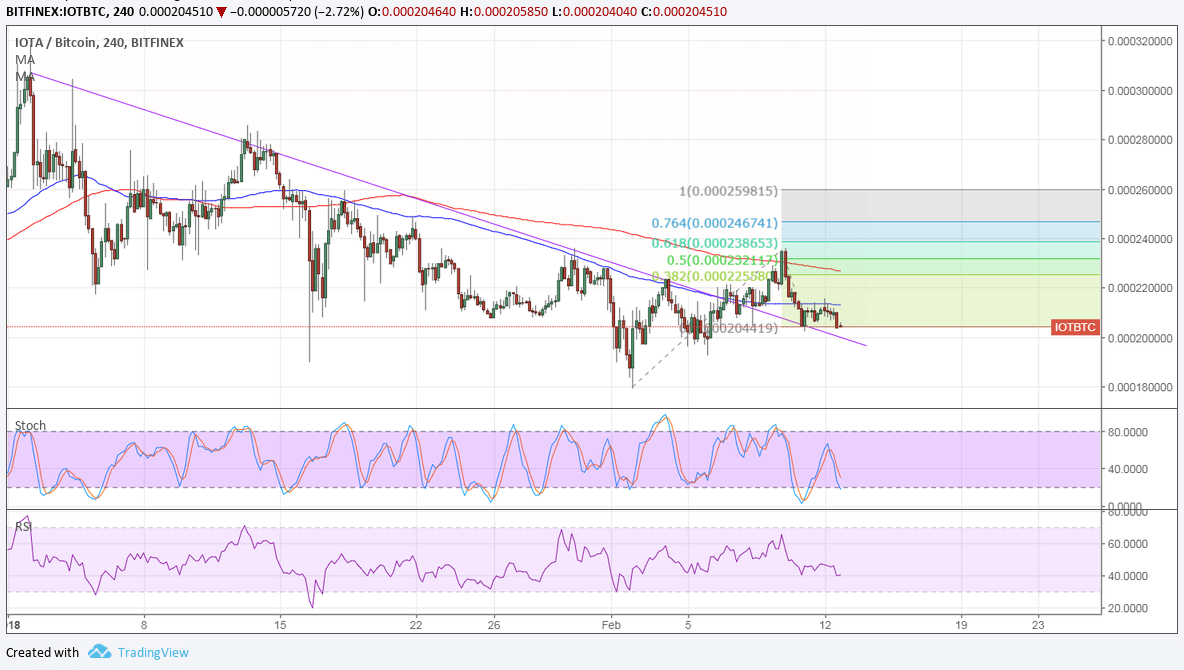

IOTA recently broke to the upside from its descending trend line against bitcoin. Price is completing its pullback and might be due for a bounce soon.

Applying the Fib extension tool shows how high price could go from here. The 38.2% extension is near the 200 SMA dynamic inflection point while the 50% extension lines up with the swing high at 0.00023. Stronger bullish momentum could take it up to the 61.8% extension at 0.00024 then the 76.4% extension or the full one at 0.00026.

However, the 100 SMA is still below the longer-term 200 SMA so the path of least resistance is to the downside, which means that the selloff is more likely to continue than to reverse. Also, stochastic and RSI are on their way down so IOTA could follow suit.

Bitcoin appears to be recovering from its selloff and keeping up with higher-yielding assets like stocks and commodities. If this keeps up, bitcoin could keep outweighing its altcoin rivals like IOTA.

As for the dollar, IOTA is still hovering around the resistance on its descending channel. The 100 SMA lines up with this upside barrier to add to its strength as a ceiling.

In addition, the 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside. This suggests that the downtrend is more likely to carry on than to reverse.

Stochastic is also heading lower to show that selling pressure could pick up while RSI is already on its way down. There are no major economic catalysts from the US today, though, so market sentiment could be the main driver.

A potential risk factor for USD trades is the upcoming release of CPI and retail sales figures, which would likely shape Fed rate hike expectations. Now these have a dual purpose of lifting the dollar and weighing on market sentiment, so stronger than expected figures could be positive for the US currency and negative for bitcoin and IOTA.