IOTA continues to trend lower against bitcoin as the latter got a boost from news of Poloniex’s acquisition. Cross-border currency exchange Circle acquired this major cryptocurrency exchange, likely allowing its reach and capabilities to expand.

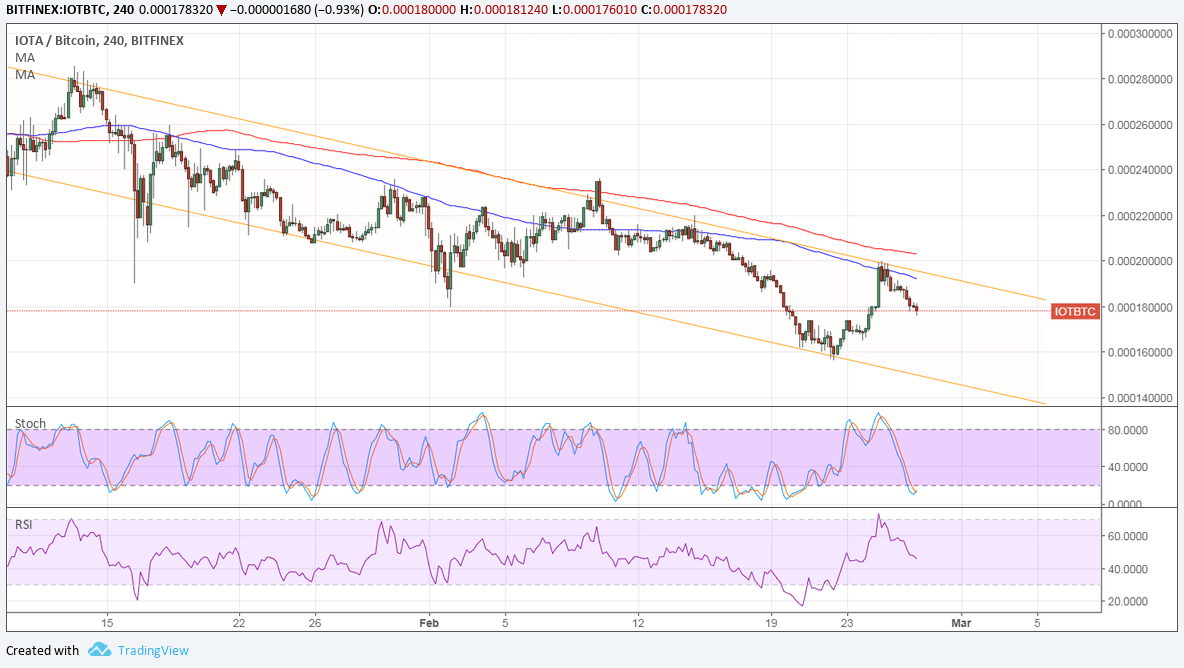

On the 4-hour chart, IOTA is in a descending channel against bitcoin and has just bounced off the resistance. The 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside. In other words, the selloff is more likely to resume than to reverse.

IOTA could be headed for the channel support around 0.00014 from here, but stochastic is already dipping into oversold territory. RSI has more room to fall so price could follow suit. In any case, the moving averages could keep holding as dynamic inflection points in the event of a pullback.

Against the dollar, IOTA has successfully broken past its descending channel resistance and is completing a pullback. Applying the Fib extension tool shows how high price could go from here.

The 100 SMA is still below the longer-term 200 SMA, though, so there’s a chance that the selloff could still resume. However, the gap has narrowed enough to signal a potential upward crossover and reversal.

In that case, IOTA could head up to the 38.2% extension at 2.0000 and breaking higher could take it to the 50% extension at the swing high next. Stronger bullish momentum could spur a climb to the 61.8% extension at 2.2659 or the 76.4% level at 2.4213. The full extension is at 2.6725.

Heading all the way up to that level could also complete an inverse head and shoulders pattern for IOTUSD, which is indicative of longer-term gains. A break past the neckline could lead to an uptrend of at least the same height as the chart formation.

The upcoming speech by new Fed head Powell is seen to be an event risk as this could lead to huge movements from the dollar. After all, he is expected to shed light on the Fed’s pace of tightening from here.