IOTA is still in the middle of a correction and continues to test the resistance levels marked in a previous post. Sellers are likely waiting for stronger catalysts before allowing the downtrend to resume but technical indicators still favor a continuation of the drop.

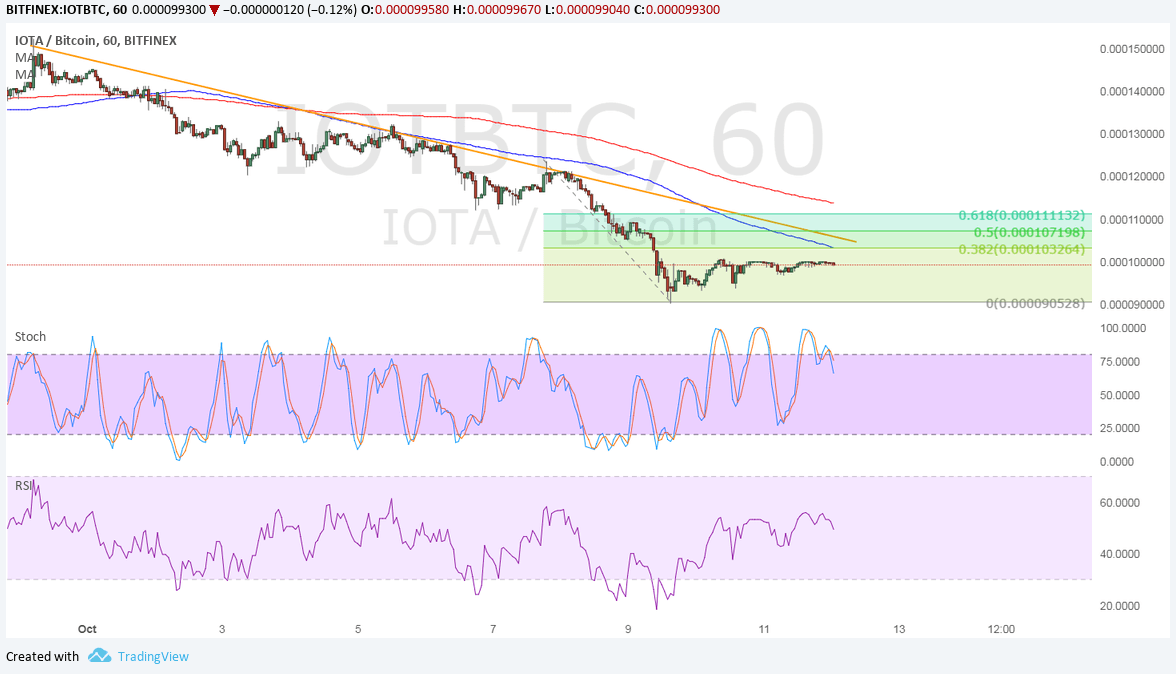

Against bitcoin, IOTA is moving below a descending trend line connecting the latest highs of price action since the start of the month. Price is edging close to the 38.2% Fib near the trend line and 100 SMA.

Speaking of moving averages, the 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside or that the selloff is set to resume. In addition, the gap between the moving averages is widening to reflect strengthening bearish pressure.

Stochastic is also turning lower from the overbought region to reflect a pickup in selling momentum. RSI is on the move up still, so there may be some bullish moves left before sellers return.

Against ethereum, IOTA is moving inside a descending channel formation. The 100 SMA is also below the longer-term 200 SMA to signal that the path of least resistance is to the downside as well. In addition, the 100 SMA coincides with the top of the channel to add to its strength as resistance.

Stochastic is pointing down to signal that sellers are on top of their game but the oscillator is also dipping into oversold regions to suggest exhaustion among bears. RSI has more room to head lower so selling pressure could stay on for much longer. A break past the 100 SMA could lead to a test of the 200 SMA dynamic resistance.

Against the dollar, IOTA is also in a descending channel and testing the resistance. This lines up with the 38.2% level and a former support zone.

Stochastic is pointing down to show that selling pressure is in play while RSI is also turning lower even without hitting overbought levels to indicate that bears are eager to return. However, the FOMC minutes turned out dollar bearish as it cast doubts for a December hike.