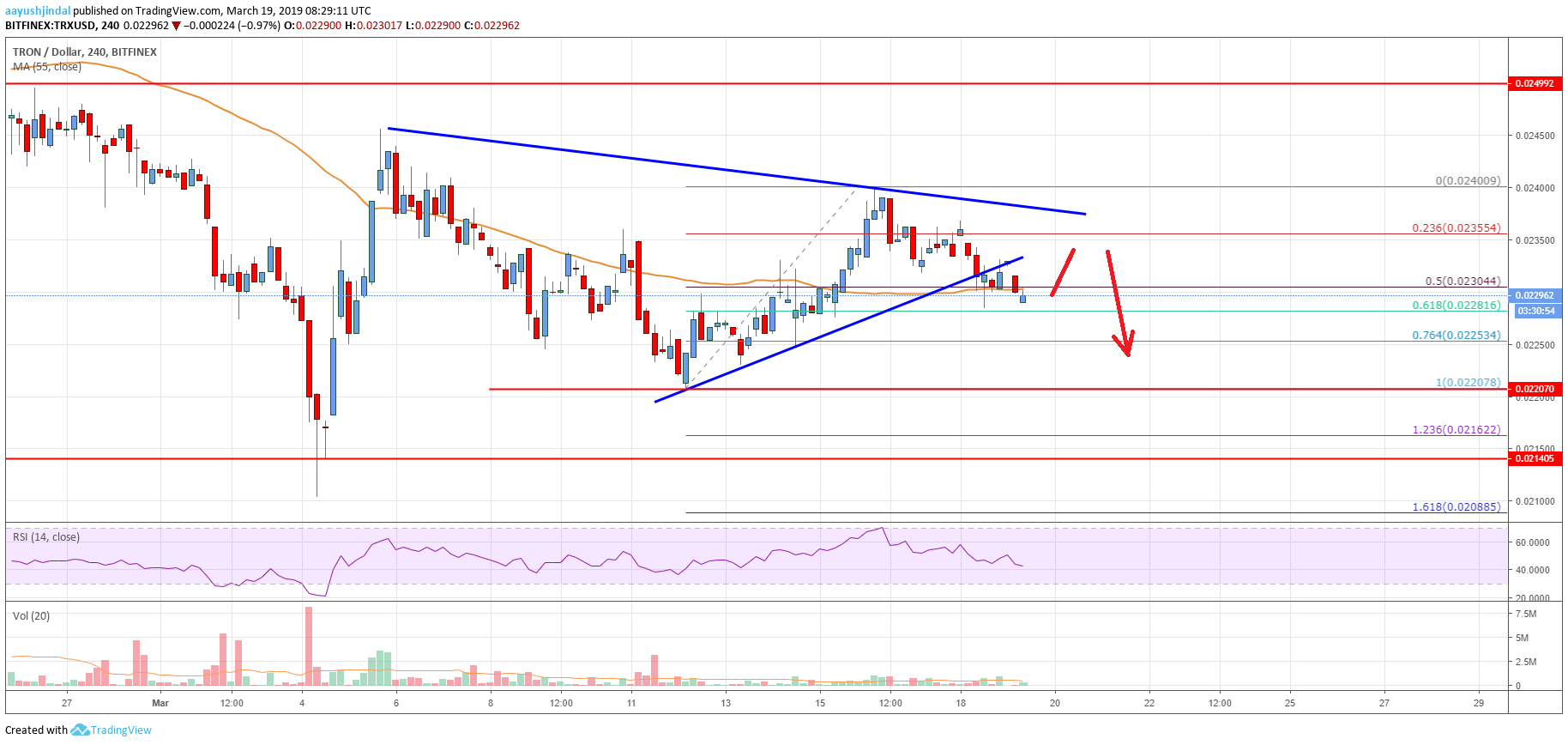

- Tron price failed to break the $0.0240 resistance and declined recently against the US Dollar.

- TRX is about to settle below the $0.0230 support and the 55 simple moving average (4-hours).

- There was a break below a key bullish trend line with support at $0.0232 on the 4-hours chart (data feed via Bitfinex).

- The price is currently at a risk of more losses below the $0.0225 and $0.0222 support levels.

TRON price is trading in a bearish zone below key supports against the US Dollar and Bitcoin. TRX is likely to accelerate losses towards $0.0220 as long as it is below $0.0240.

Tron Price Analysis

This past week, there was a slow and steady rise in TRON price from the $0.0220 support against the US Dollar. The TRX/USD pair gained traction above the $0.0225 and $0.0230 resistance levels. There was also a close above the $0.0230 resistance and the 55 simple moving average (4-hours). However, the price failed to clear the main resistance at $0.0240. A swing high was formed at $0.0240 and later the price started a downside move.

It broke the $0.0232 support and the 23.6% Fibonacci retracement level of the last wave from the $0.0220 low to $0.0240 high. Besides, there was a break below a key bullish trend line with support at $0.0232 on the 4-hours chart. The pair is about to settle below the $0.0230 support, the 55 simple moving average (4-hours), and the 50% Fibonacci retracement level of the last wave from the $0.0220 low to $0.0240 high. Therefore, there is a risk of more losses below the $0.0228 support level.

The next key support is at $0.0225 and the 76.4% Fibonacci retracement level of the last wave from the $0.0220 low to $0.0240 high. Any further losses could push the price back towards the $0.0220 swing low. On the upside, an initial resistance is at $0.0235. The main hurdle for buyers is near $0.0240, above which the price is likely to gain bullish momentum.

The chart indicates that TRX price is slowly moving into a bearish zone below the $0.0230 support and the 55 simple moving average (4-hours). If sellers gain strength, the price could decline sharply towards the $0.0220 support. In the worst case, the price may revisit the $0.0215 swing low, where buyers might emerge. On the upside, buyers need to clear $0.0235 and $0.0240.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining strength in the bearish zone, with negative signs.

4 hours RSI – The RSI for TRX/USD moved below the 50 level and it is declining with a bearish angle.

Key Support Levels – $0.0225 and $0.0220

Key Resistance Levels – $0.0232, $0.0235 and $0.0240.