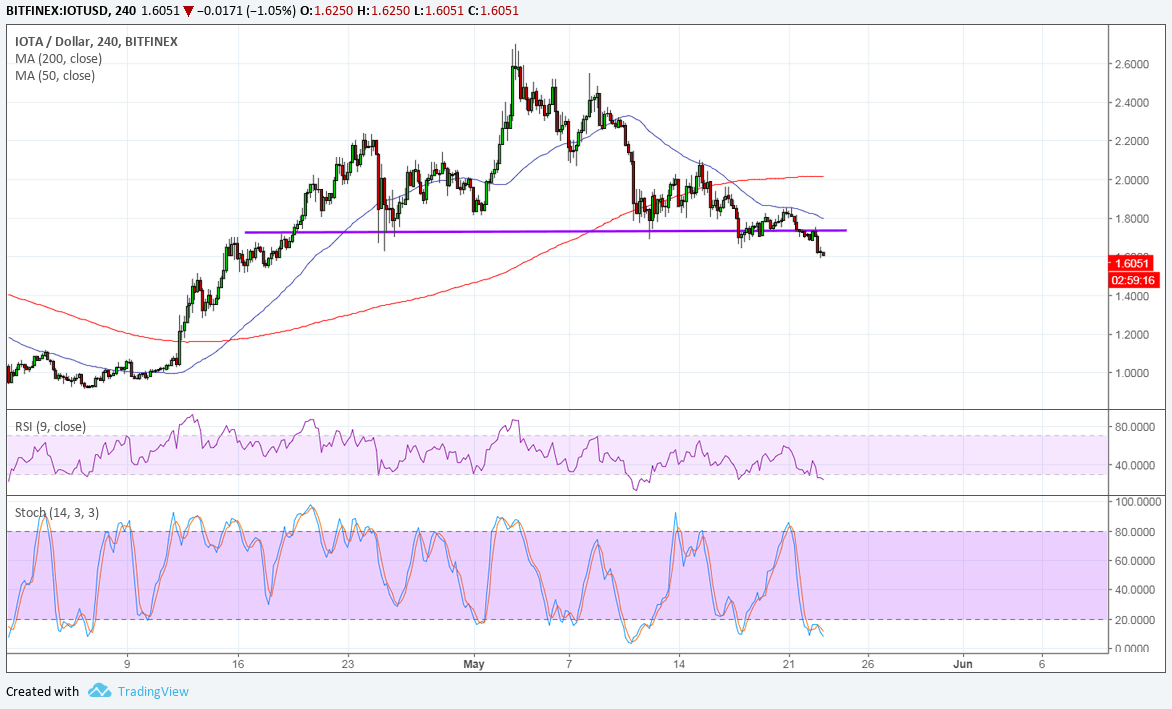

IOTA broke below the neckline of its head and shoulders pattern to signal that a downtrend is underway. This chart pattern spans 1.8000 to 2.6000 so the resulting selloff could last by 0.8000.

The 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside. In other words, the downtrend is more likely to continue than to reverse. The gap between the moving averages is widening to reflect strengthening bearish momentum.

RSI is on the move down so IOTA could follow suit while sellers have the upper hand. However, this oscillator is dipping into oversold territory to reflect exhaustion among sellers. Stochastic is also indicating oversold conditions and turning higher could bring buyers back in.

There have been no major updates in the cryptocurrency industry recently, although it’s worth noting that FOMC member Kashkari had another set of negative remarks. In particular, he mentioned:

It’s a clever idea that some people came up with, but now it’s being taken to ridiculous extremes. The barrier to entry to creating a new cryptocurrency is zero.

He even called ICOs a farce, citing:

If you can dupe enough people to buy it, you can pretend that you’ve launched something. And you can say, ‘Look, I’m a billionaire because I sold you one. And I own the other 999 million of them, so that means I’m a billionaire! So it has become a farce…I’m seeing more noise and more fraud than I’m seeing anything useful.

In the absence of any positive developments in the industry over the past few weeks, IOTA and its peers were more vulnerable to these remarks than usual. Besides, the pickup in risk aversion on account of resurfacing geopolitical tensions also weighed on these riskier assets.

Looking ahead, the FOMC minutes might be the next catalyst, unless there are other factors that could move the altcoins specifically.