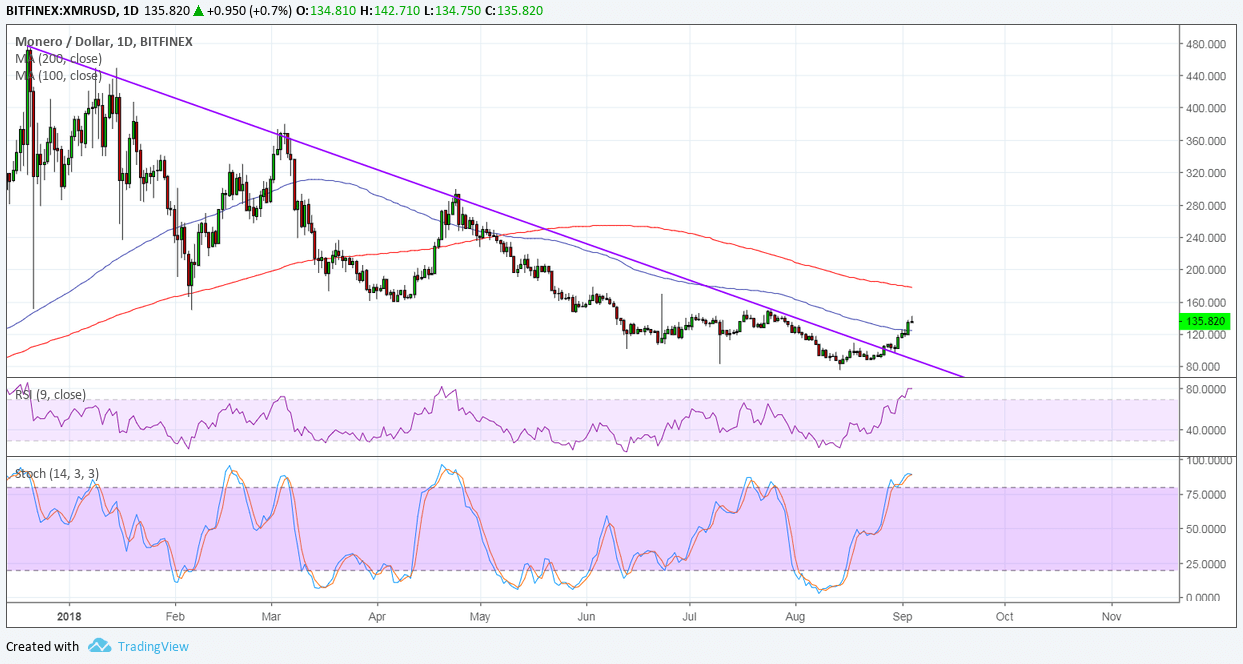

Monero recently surged past its long-term descending trend line to signal that the downtrend is over. Technical indicators are suggesting a continuation of the drop on the daily time frame, though.

For one, the 100 SMA is below the longer-term 200 SMA to show that the path of least resistance is to the downside. This means that the selloff is more likely to resume than to reverse. The gap is also sufficiently wide to show that there’s no imminent crossover yet.

RSI is indicating overbought conditions or that buyers are feeling exhausted at this point and may let sellers take over. Similarly, stochastic is in the overbought zone and may be due to turn lower to reflect a return in selling pressure.

However, this could simply mean that a pullback is in order before bulls gain more momentum. Zooming in to the short-term time frame shows that price is just starting to form a rising trend line where more buyers might be hoping to catch better prices.

This rising trend line lines up with the 61.8% retracement level on the 1-hour time frame. The 100 SMA is above the longer-term 200 SMA on this chart to signal that the path of least resistance is to the upside, at least in the short-term.

However, RSI is also turning south to signal bearish pressure, along with stochastic. A shallow pullback could find support at the 38.2% Fib around $134 or the 50% level at $131.25. A break below these levels could mean a larger pullback to the 100 SMA dynamic inflection point near the swing low.

Monero’s strong moves are partly being pinned on very bullish forecasts by Satis ICO Advisory Research group, which predicts that price could hit $18,000 over the next five years. This would mark a 12,000 increase for the coin, which is currently below the $150 mark.

Images courtesy of TradingView.